Stock Sip Vs Mutual Fund Sip Choose The Right Sip Angel One

Stock Sip Vs Mutual Fund Sip Choose The Right Sip Angel One Know the differences between stock sip and mutual fund sip to make informed investment decisions. learn the risks, benefits, and potential returns of each option. In this blog, you will understand everything — what a mutual fund sip is, what a stock sip is, their key features, differences, tax implications, factors to consider before choosing, comparison of their returns, and finally, which one might be better for you.

Stock Sip Vs Mutual Fund Sip Choose The Right Sip Angel One Explore the features and differences of stock sip and mutual funds sip to understand which is the right choice for your investment portfolio. Use a mutual fund sip for your core portfolio and complement it with a stock sip in 2–3 high conviction stocks. this strategy helps balance professional management and personal conviction. Most investors associate sips with mutual funds, but did you know you can also use stock sips to invest directly in stocks? in this guide, we break down the basics of both types of sips — mutual fund sips vs stock sips, how they work, how they differ, and how to use tools like sip calculators to plan your journey. what is a mutual fund sip?. Stock sip is an investment method under which individuals put a certain amount of money at regular intervals at a pre fixed date in a specific stock. this permits shares to be accumulated over time.

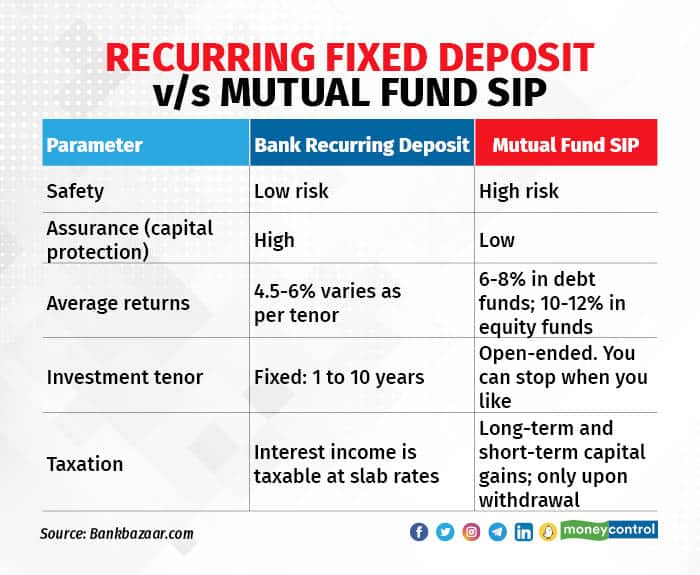

Stock Sip Vs Mutual Fund Sip Key Differences Explained Share India Most investors associate sips with mutual funds, but did you know you can also use stock sips to invest directly in stocks? in this guide, we break down the basics of both types of sips — mutual fund sips vs stock sips, how they work, how they differ, and how to use tools like sip calculators to plan your journey. what is a mutual fund sip?. Stock sip is an investment method under which individuals put a certain amount of money at regular intervals at a pre fixed date in a specific stock. this permits shares to be accumulated over time. Stock sips give you full control, while mutual fund sips are easier to maintain. which option suits you better? still unsure whether to choose a stock sip vs mutual fund sip? here’s a simple breakdown to help you decide based on your investing style and goals:. The choice between mutual fund sip investment and direct stock investing depends on your financial goals, risk tolerance, time, and knowledge of the market. if you are new to investing and prefer a simpler, less risky approach, mutual fund sip is likely a better choice. Mutual fund sips ensure professional management along with the benefits of diversification and liquidity at a relatively low cost. on the other hand, stock sips give the ability to focus on one particular stock, but would involve research and would come with concentration risks. Sip, or systematic investment plan, is essentially a disciplined approach to investing. instead of putting a lump sum amount into an asset, you invest a fixed sum regularly, say, monthly, or quarterly.

Sip Vs Mutual Fund Differences You Should Know 56 Off Stock sips give you full control, while mutual fund sips are easier to maintain. which option suits you better? still unsure whether to choose a stock sip vs mutual fund sip? here’s a simple breakdown to help you decide based on your investing style and goals:. The choice between mutual fund sip investment and direct stock investing depends on your financial goals, risk tolerance, time, and knowledge of the market. if you are new to investing and prefer a simpler, less risky approach, mutual fund sip is likely a better choice. Mutual fund sips ensure professional management along with the benefits of diversification and liquidity at a relatively low cost. on the other hand, stock sips give the ability to focus on one particular stock, but would involve research and would come with concentration risks. Sip, or systematic investment plan, is essentially a disciplined approach to investing. instead of putting a lump sum amount into an asset, you invest a fixed sum regularly, say, monthly, or quarterly.

Stock Sip Vs Mutual Fund Sip Which One Should You Choose By Mutual fund sips ensure professional management along with the benefits of diversification and liquidity at a relatively low cost. on the other hand, stock sips give the ability to focus on one particular stock, but would involve research and would come with concentration risks. Sip, or systematic investment plan, is essentially a disciplined approach to investing. instead of putting a lump sum amount into an asset, you invest a fixed sum regularly, say, monthly, or quarterly.

Stock Sip Vs Mutual Fund Sip

Comments are closed.