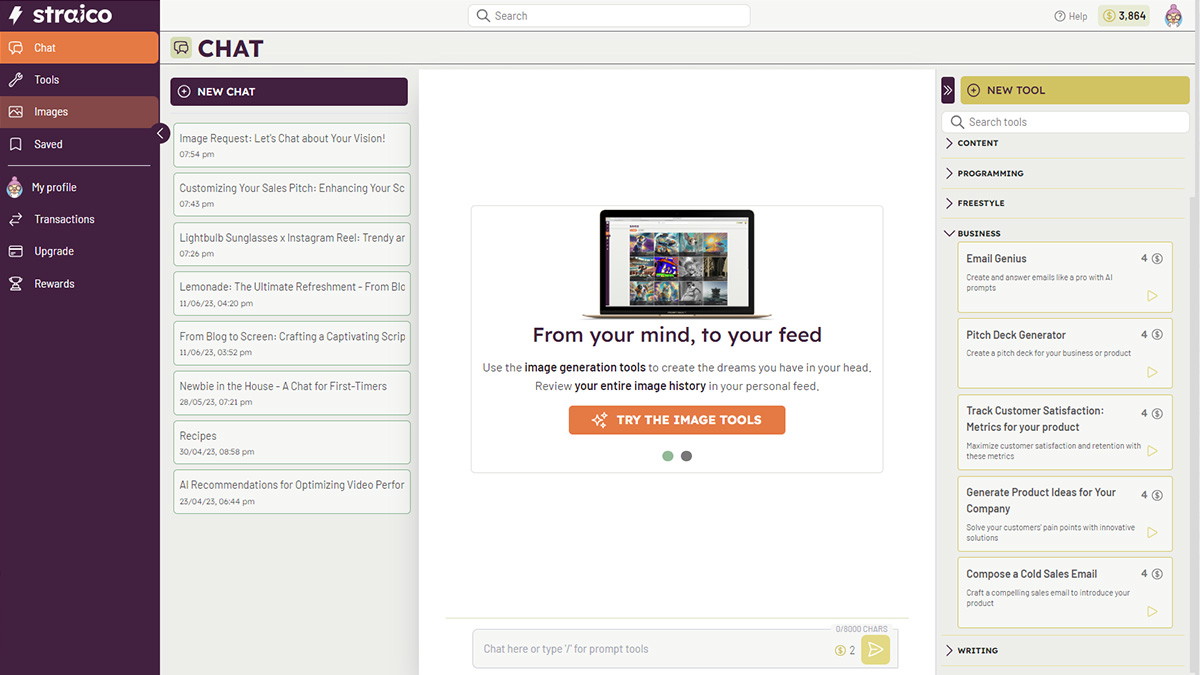

Straico Review And Lifetime Deal Write Ai Prompts To Build New Tools Generative Ai Platform

Straico Lifetime Deal Review 73 Off Discountsai Tools The cra’s tax benefits come with conditions. these mistakes can make the tfsa withdrawals taxable in a different scenario. Navigating your tax free savings account (tfsa) is simpler than you might think, especially when it comes to making withdrawals. whether you’re assessing the tfsa contribution limit for 2024 or wondering about the nuances of withdrawals, this article is your go to resource.

Straico Lifetime Deal Create Content Visuals With Ai Learn essential tfsa withdrawal rules, contribution tips, and tax implications in canada. master how tfsa withdrawals work to boost your financial future with questrade. With a tfsa, any income earned in that account, whether via interest earning savings, etfs, bonds, or stocks, is tax free. tfsas are very flexible, meaning you can withdraw from them without getting hit with a penalty or nasty withdrawal taxes. Contributions to a tfsa are not deductible for income tax purposes. any amount contributed as well as any income earned in the account (for example, investment income and capital gains) is. There are certain situations where you may have to pay taxes on a tfsa withdrawal, such as if you over contribute to your tfsa, make non resident contributions, or have prohibited or non qualified investments.

Straico Ai Details Review In 2024 Key Features Use Case And Pricing Contributions to a tfsa are not deductible for income tax purposes. any amount contributed as well as any income earned in the account (for example, investment income and capital gains) is. There are certain situations where you may have to pay taxes on a tfsa withdrawal, such as if you over contribute to your tfsa, make non resident contributions, or have prohibited or non qualified investments. You can withdraw from your tax free savings account (tfsa) at any time and for any reason, with no tax consequences. If you’re not careful, you could raise one of several cra tfsa red flags —and that could cost you. here’s a detailed look at the most common red flags and how to avoid them. The cra’s tax benefits come with conditions. these mistakes can make the tfsa withdrawals taxable in a different scenario. the post 3 mistakes that could make tfsa withdrawals taxable appeared. Despite the benefits and versatility of tfsas, mistakes can happen which can cost you a lot of money. here are some common tfsa mistakes to avoid.

Straico Lifetime Deal 49 Review Create Content Visuals With Ai You can withdraw from your tax free savings account (tfsa) at any time and for any reason, with no tax consequences. If you’re not careful, you could raise one of several cra tfsa red flags —and that could cost you. here’s a detailed look at the most common red flags and how to avoid them. The cra’s tax benefits come with conditions. these mistakes can make the tfsa withdrawals taxable in a different scenario. the post 3 mistakes that could make tfsa withdrawals taxable appeared. Despite the benefits and versatility of tfsas, mistakes can happen which can cost you a lot of money. here are some common tfsa mistakes to avoid.

Comments are closed.