Svb Crisis The Ripple Effect Of The Suddenly Collapsed Svb Has The collapse of silicon valley bank, the second largest bank failure in u.s. history, has created a ripple effect across the american financial industry. svb was taken over by the federal. Svb’s collapse has had a knock on effect in international markets, impacted the reputation of svb’s international partners and brought uncertainty for its overseas employees. europe european banking stocks have been sinking in the last few days following the news of svb’s collapse.

Banking Shock After Svb Collapse Complicates Federal Reserve S The collapse of svb in march 2023 and two other us based banks, namely, silvergate bank and signature bank, has triggered a wave of panic across the banking industry, reigniting fears of contagion and its far reaching ramifications in the global financial system. The collapse of both svb and cryptocurrency bank silvergate on march 15, 2023, has sparked fears of contagion and drew uncomfortable comparisons to the great recession. The collapse of svb had a ripple effect on the economy, with many small businesses and startups strugglingto access funding. the bank's customers, including many tech companies, were left scrambling to find alternative financial solutions. Silicon valley bank (svb) collapsed one year ago on sunday, an event which created a ripple effect of widespread damage across the financial sector. the failure of svb was the third largest.

Svb Collapse Silicon Valley Greed And Regulatory Failure To Blame The collapse of svb had a ripple effect on the economy, with many small businesses and startups strugglingto access funding. the bank's customers, including many tech companies, were left scrambling to find alternative financial solutions. Silicon valley bank (svb) collapsed one year ago on sunday, an event which created a ripple effect of widespread damage across the financial sector. the failure of svb was the third largest. Four minority founders reflect on the health of minority owned banks in the u.s. following the sudden collapse of svb. The svb collapsed on march 10th, 2023, and is marked as the largest bank failure since the financial crisis. founded in 1983, svb specialized in banking for tech startups. The collapse of silicon valley bank, svb, sent shockwaves through the financial system, reviving memories of the global crisis in 2008. svb failed because of mistakes made by the bank, the financial authorities, and the bank’s clients. The silicon valley bank (svb) fallout was a result of both systemic and idiosyncratic factors. systemic factors: svb had a concentrated deposit base that grew rapidly throughout the covid 19 pandemic, with most of those deposits being uninsured.

Svb Fall Creates Ripple Effect Indian It Caught In The Wave Four minority founders reflect on the health of minority owned banks in the u.s. following the sudden collapse of svb. The svb collapsed on march 10th, 2023, and is marked as the largest bank failure since the financial crisis. founded in 1983, svb specialized in banking for tech startups. The collapse of silicon valley bank, svb, sent shockwaves through the financial system, reviving memories of the global crisis in 2008. svb failed because of mistakes made by the bank, the financial authorities, and the bank’s clients. The silicon valley bank (svb) fallout was a result of both systemic and idiosyncratic factors. systemic factors: svb had a concentrated deposit base that grew rapidly throughout the covid 19 pandemic, with most of those deposits being uninsured.

Svb Collapse Could Have Ripple Effects On Minority Owned Banks Wbur The collapse of silicon valley bank, svb, sent shockwaves through the financial system, reviving memories of the global crisis in 2008. svb failed because of mistakes made by the bank, the financial authorities, and the bank’s clients. The silicon valley bank (svb) fallout was a result of both systemic and idiosyncratic factors. systemic factors: svb had a concentrated deposit base that grew rapidly throughout the covid 19 pandemic, with most of those deposits being uninsured.

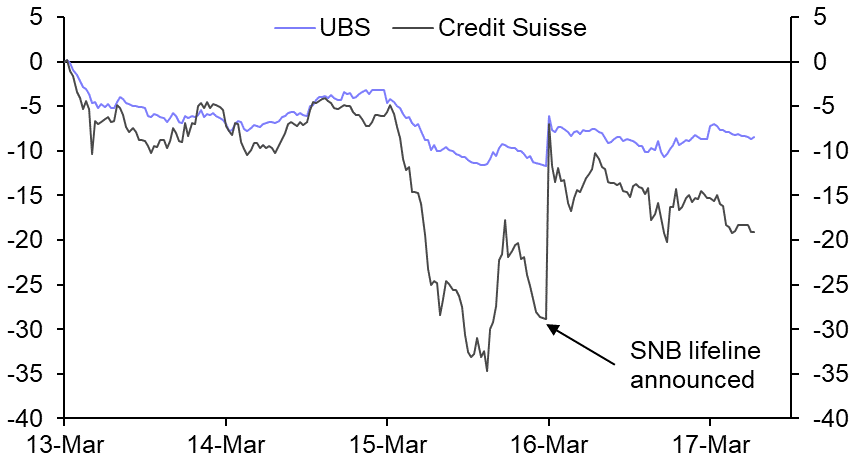

The Svb Collapse The Next Financial Crisis Capital Economics