Counterfeit Detector Buyer S Guide Effective Counterfeit Document Synthetic identity fraud is different. it can be thought of as a hybrid form of identity crime whereby perpetrators leverage stolen elements of real identities to manufacture entirely new,. Manipulated synthetic identities can be detected by more robust fraud and identity checks, as they often collide with the true identity they are imitating. the challenge.

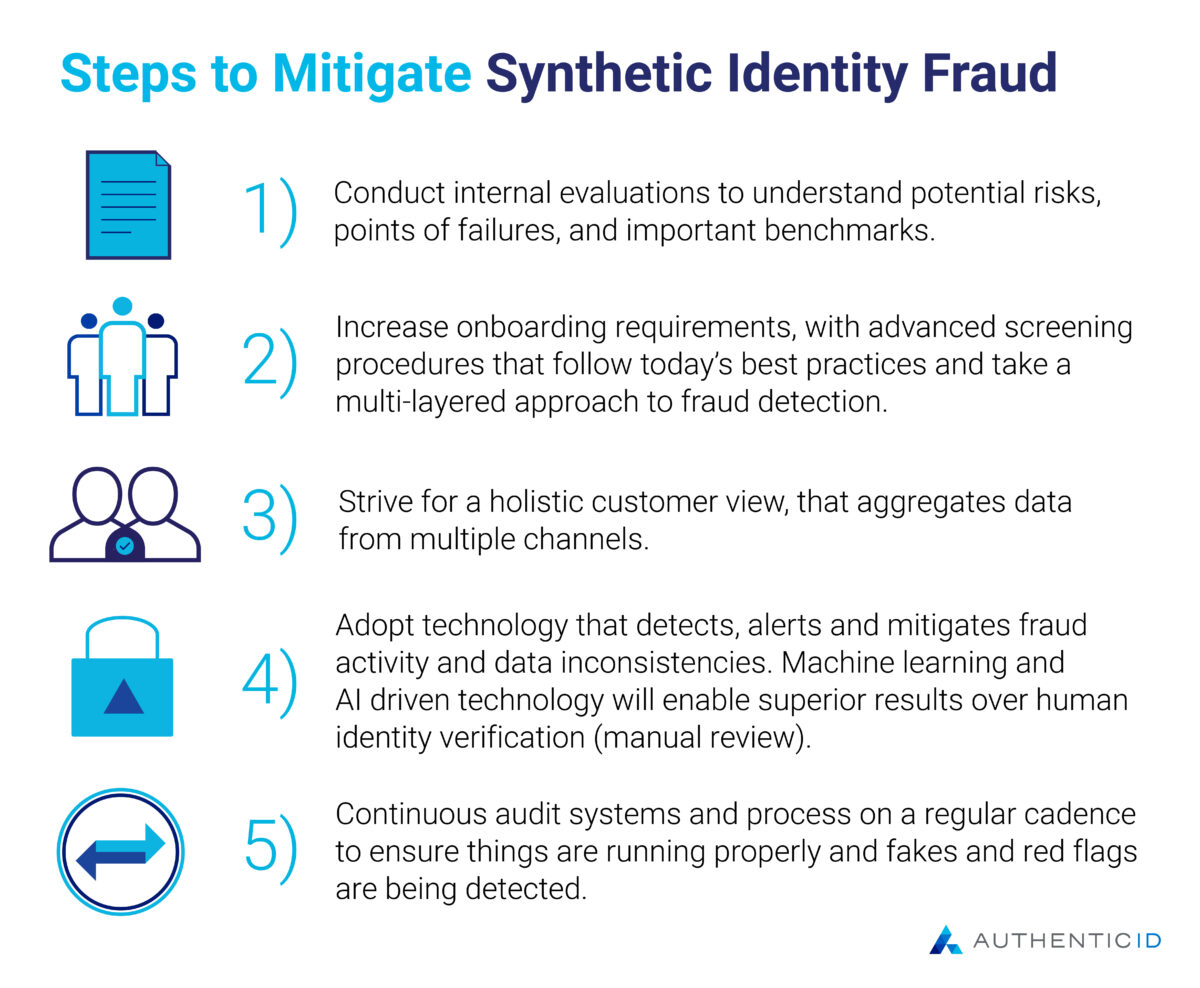

Synthetic Identity Fraud Authenticid Synthetic identity fraud occurs when perpetrators combine fictitious and sometimes, real information, such as names and social security numbers (ssns), to create new identities – which then may be used. As the fastest growing financial crime in the united states, synthetic identity fraud bears a staggering $6 billion cost to banks. 1 to perpetrate the crime, malicious actors leverage a combination of real and fake information to fabricate. This document discusses 5 key capabilities that effective synthetic id detection solutions should have: 1) access a wide range of id verification data; 2) perform "velocity" checks to detect suspicious activity patterns; 3) monitor and review activity in real time; 4) minimize false positive results; 5) offer industry specific features to. Synthetic identity (also known as synthetic id) fraud happens when the information shared to establish identity appears valid but is not. when this takes place, trust is incorrectly established and given to a fictitious entity. synthetic ids serve one of the core desires of fraudsters: the desire to remain undetected. fraudsters.

Synthetic Identity Fraud Authenticid This document discusses 5 key capabilities that effective synthetic id detection solutions should have: 1) access a wide range of id verification data; 2) perform "velocity" checks to detect suspicious activity patterns; 3) monitor and review activity in real time; 4) minimize false positive results; 5) offer industry specific features to. Synthetic identity (also known as synthetic id) fraud happens when the information shared to establish identity appears valid but is not. when this takes place, trust is incorrectly established and given to a fictitious entity. synthetic ids serve one of the core desires of fraudsters: the desire to remain undetected. fraudsters. What is synthetic identity fraud (sif)? synthetic identity fraud theft is a type of fraud in which a criminal combines real identity attributes (eg. social security numbers (ssn) acquired via hacking phishing) with fake personally identifiable information (pii). for example, a synthetic identity may be comprised of a real ssn. Synthetic identity fraud is an emerging fraud risk type that has been perpetuated by fraudsters with such stealth and success that there are few estimates regarding the magnitude of impact for this type. Bottom line: criminals and fraudsters have figured out how to game the u.s. credit system and sidestep kyc requirements to create synthetic identities, and are now able to commit financial crimes with impunity. the u.s. financial system is oficially under siege from a new and growing form of criminal activity known as synthetic identity fraud. Industry experts agree that synthetic identity payments fraud is dificult to measure due to inconsistencies in definitions and detection approaches. the figures throughout this paper are estimates that illustrate the potential magnitude of synthetic identity fraud in the united states overall and, specifically, in the payments industry.

Synthetic Identity Fraud Authenticid What is synthetic identity fraud (sif)? synthetic identity fraud theft is a type of fraud in which a criminal combines real identity attributes (eg. social security numbers (ssn) acquired via hacking phishing) with fake personally identifiable information (pii). for example, a synthetic identity may be comprised of a real ssn. Synthetic identity fraud is an emerging fraud risk type that has been perpetuated by fraudsters with such stealth and success that there are few estimates regarding the magnitude of impact for this type. Bottom line: criminals and fraudsters have figured out how to game the u.s. credit system and sidestep kyc requirements to create synthetic identities, and are now able to commit financial crimes with impunity. the u.s. financial system is oficially under siege from a new and growing form of criminal activity known as synthetic identity fraud. Industry experts agree that synthetic identity payments fraud is dificult to measure due to inconsistencies in definitions and detection approaches. the figures throughout this paper are estimates that illustrate the potential magnitude of synthetic identity fraud in the united states overall and, specifically, in the payments industry.

Synthetic Identity Fraud How To Prevent It Fraud Bottom line: criminals and fraudsters have figured out how to game the u.s. credit system and sidestep kyc requirements to create synthetic identities, and are now able to commit financial crimes with impunity. the u.s. financial system is oficially under siege from a new and growing form of criminal activity known as synthetic identity fraud. Industry experts agree that synthetic identity payments fraud is dificult to measure due to inconsistencies in definitions and detection approaches. the figures throughout this paper are estimates that illustrate the potential magnitude of synthetic identity fraud in the united states overall and, specifically, in the payments industry.