Tax Filing Delays From Irs And Payment Deadlines One More Month Ir 2025 51, april 16, 2025 — the internal revenue service encourages taxpayers who missed the filing deadline to submit their tax return as soon as possible. the irs offers options for taxpayers who need help paying their tax bill. for more individuals can pay taxes owed securely through irs online account, irs direct pay. Irs tax tip 2025 27, april 17, 2025. taxpayers who missed the april 15 filing deadline should submit their tax return as soon as possible. those who missed the deadline to file but owe taxes should file timely to avoid penalties and interest. requesting an extension allows for additional time to file but not to pay taxes owed.

Irs Tax Filing And Tax Payment Deadlines Moved Tax Helpers The irs offers several payment plans and relief services if you can't pay your full tax bill right away: short term payment plan: greene lewis suggests using this plan if you're able to pay what. Tax payment deadlines and slow irs filings: what you need to know. every year, the deadline to file and pay federal income taxes in the united states falls on april 15 (unless it lands on a weekend or holiday, in which case it may be extended). for most taxpayers, april 15 is the key date to remember in order to avoid penalties and interest. Taxpayers who missed the april tax filing and payment deadline should file as soon as they can. the irs offers resources to help those who may be unable to pay their tax bill in total. those who missed the deadline to file but owe taxes should file quickly to minimize penalties and interest. Need to file taxes? get 2025 deadlines for irs and california returns, find free filing options and see expert tips on avoiding delays on federal, state refunds.

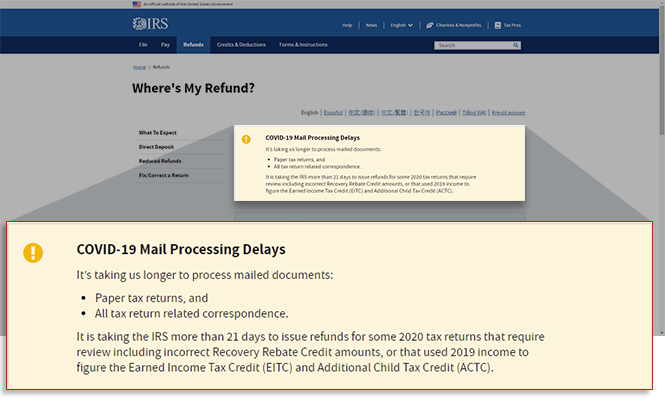

The Irs Has Extended Payment Due Dates The Washington Post Taxpayers who missed the april tax filing and payment deadline should file as soon as they can. the irs offers resources to help those who may be unable to pay their tax bill in total. those who missed the deadline to file but owe taxes should file quickly to minimize penalties and interest. Need to file taxes? get 2025 deadlines for irs and california returns, find free filing options and see expert tips on avoiding delays on federal, state refunds. The internal revenue service (irs) has reminded taxpayers who missed tuesday's filing deadline that prompt action can help them reduce or avoid penalties and interest why it matters. missing a. Between the 2 federally declared disasters, taxpayers in all 100 n.c. counties automatically qualify for the may 1 deadline for filing and paying any federal taxes due,” a spokesperson for the. Taxpayers in several states, including arkansas, tennessee, and kentucky, have received tax filing and payment extensions due to severe weather. residents of alabama, georgia, north carolina. Many people who claim the earned income tax credit or the additional child tax credit need to anticipate delays. the irs said taxpayers claiming those credits can expect to get refunds by.

Irs Delays Tax Filing Deadline Alltop Viral The internal revenue service (irs) has reminded taxpayers who missed tuesday's filing deadline that prompt action can help them reduce or avoid penalties and interest why it matters. missing a. Between the 2 federally declared disasters, taxpayers in all 100 n.c. counties automatically qualify for the may 1 deadline for filing and paying any federal taxes due,” a spokesperson for the. Taxpayers in several states, including arkansas, tennessee, and kentucky, have received tax filing and payment extensions due to severe weather. residents of alabama, georgia, north carolina. Many people who claim the earned income tax credit or the additional child tax credit need to anticipate delays. the irs said taxpayers claiming those credits can expect to get refunds by.

Irs Tax Payment Processing Delays Taxcaddy Taxpayers in several states, including arkansas, tennessee, and kentucky, have received tax filing and payment extensions due to severe weather. residents of alabama, georgia, north carolina. Many people who claim the earned income tax credit or the additional child tax credit need to anticipate delays. the irs said taxpayers claiming those credits can expect to get refunds by.