Tax Justice Transformational Moments Of 2024 Tax Justice Network Credit sesame explains the new tax rules for 2024 and how they may impact your tax bill, deductions, and tax credits. tax laws evolve every year, and 2024 is no exception. understanding the latest updates can help you maximize your refund, reduce your tax bill, and plan smarter for the future. Navigating the 2024 tax changes what you need to know the tax brackets you fall into the standard deduction in 2024 is $14,600 for a single filer and $29,200 for married couples filing jointly, so your total deductions need to be more than did you know is a new tax form introduced by the irs to standardize the reporting of digital asset.

Understanding Taxation Law 2024 And Concise Tax Legislation 2024 Here are the standard deduction amounts for the 2023 tax returns that will be filed in 2024. taxpayers who are 65 and older, or are blind, are eligible for an additional standard deduction. Understanding the inflation reduction act and the new tax laws for 2024 is crucial for any tax preparer. these changes in tax laws for 2024 are set to impact taxpayers significantly. The irs announced thursday annual inflation adjustments for over 60 tax provisions in tax year 2024, including increases in the standard deduction for married couples and single individuals. these tax year 2024 adjustments generally apply to tax returns that will be filed in 2025. included are the tax rate schedules and other tax changes. rev. proc. 2023 24 provides details about these annual. Explore the 2024 updates to tax provisions and deductions, including changes to rates, credits, and limits affecting taxpayers. tax provisions and deductions are integral to financial planning, shaping both individual and business fiscal responsibilities.

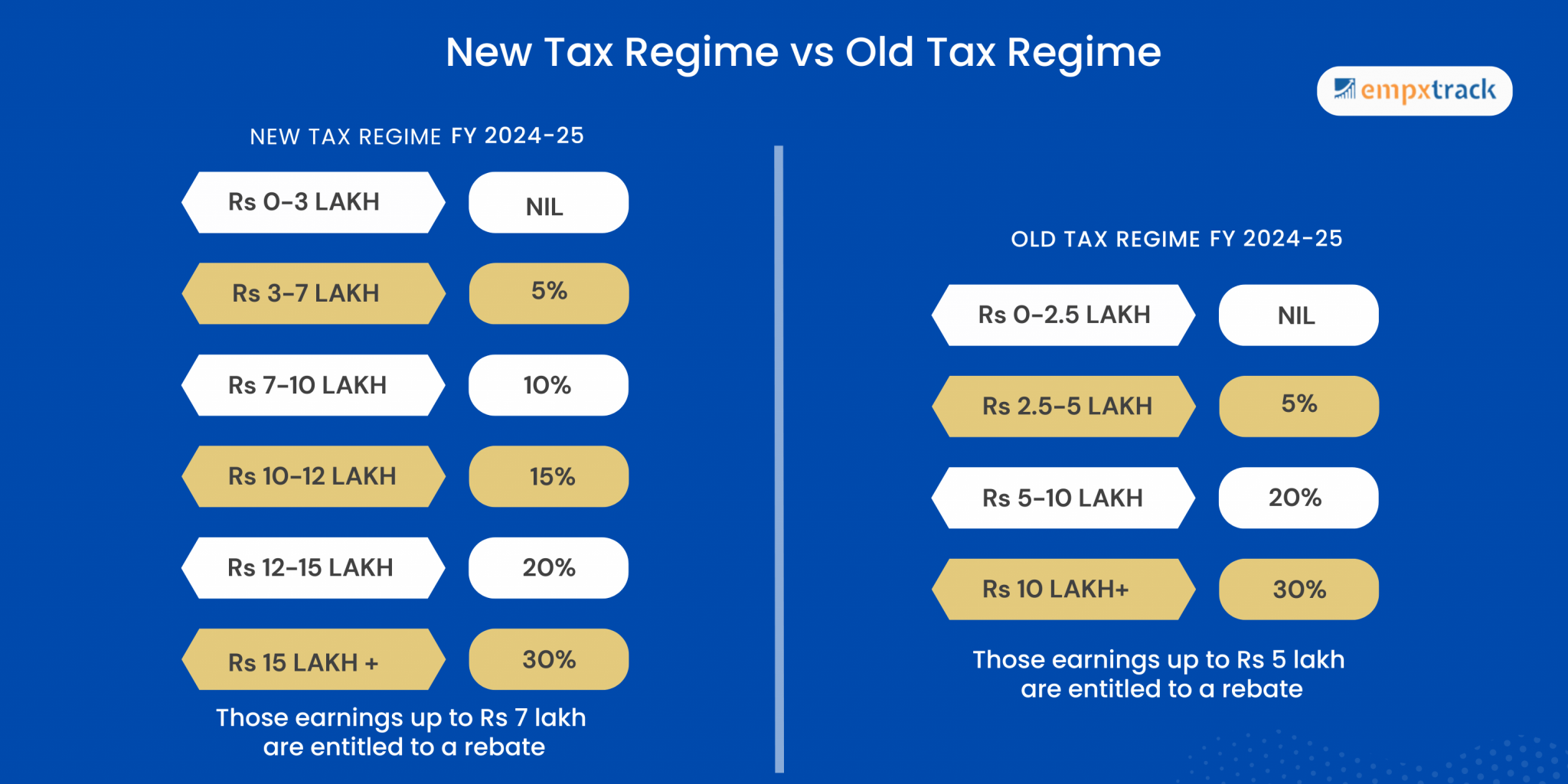

New Income Tax Rules 2024 Empxtrack The irs announced thursday annual inflation adjustments for over 60 tax provisions in tax year 2024, including increases in the standard deduction for married couples and single individuals. these tax year 2024 adjustments generally apply to tax returns that will be filed in 2025. included are the tax rate schedules and other tax changes. rev. proc. 2023 24 provides details about these annual. Explore the 2024 updates to tax provisions and deductions, including changes to rates, credits, and limits affecting taxpayers. tax provisions and deductions are integral to financial planning, shaping both individual and business fiscal responsibilities. The 2024 tax season brings new legislation that affects businesses of all sizes. let us provide key post tax season insights into the recent legislative changes and how they impact different business structures. As we step into 2025, it’s important to stay informed about the latest tax changes that could impact your return. from updated tax brackets to new rules for deductions and credits, understanding these changes can help you prepare effectively and avoid surprises. The five major 2024 tax changes cover income tax brackets, the standard deduction, retirement contribution limits, the gift tax exclusion and phase out levels for individual retirement account (ira) deductions, roth iras and the saver’s credit. As we approach the 2024 tax year, several key adjustments are coming into effect that taxpayers need to be aware of. it’s crucial to stay informed about these updates to ensure your tax planning is both effective and efficient. therefore, let’s delve into the specific changes that will impact taxpayers in the upcoming year. 1.

Income Tax Third Amendment Rules 2024 Notification Of Form Itr 7 The 2024 tax season brings new legislation that affects businesses of all sizes. let us provide key post tax season insights into the recent legislative changes and how they impact different business structures. As we step into 2025, it’s important to stay informed about the latest tax changes that could impact your return. from updated tax brackets to new rules for deductions and credits, understanding these changes can help you prepare effectively and avoid surprises. The five major 2024 tax changes cover income tax brackets, the standard deduction, retirement contribution limits, the gift tax exclusion and phase out levels for individual retirement account (ira) deductions, roth iras and the saver’s credit. As we approach the 2024 tax year, several key adjustments are coming into effect that taxpayers need to be aware of. it’s crucial to stay informed about these updates to ensure your tax planning is both effective and efficient. therefore, let’s delve into the specific changes that will impact taxpayers in the upcoming year. 1.