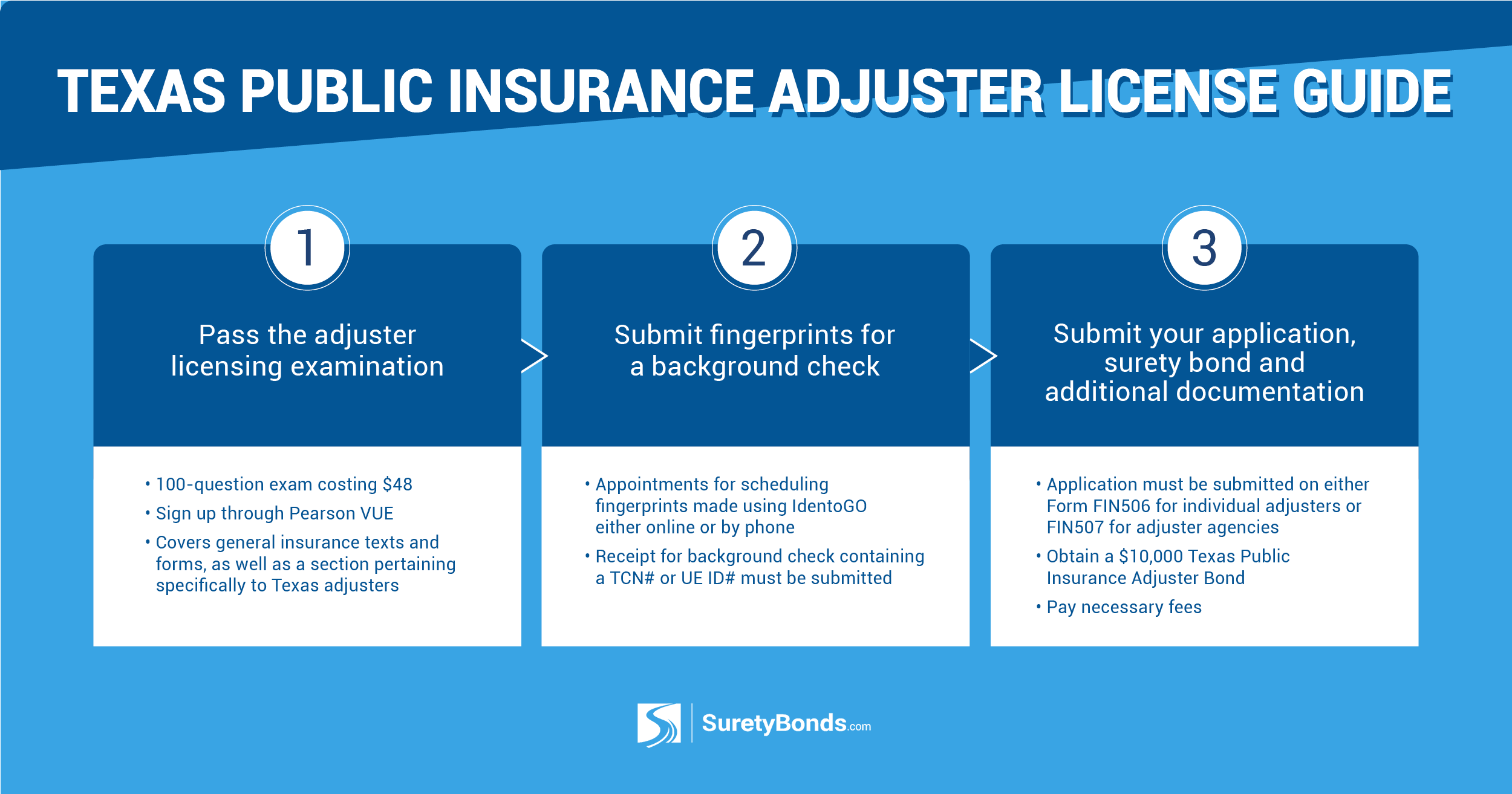

Texas Public Insurance Adjuster Licensing A 2017 Guide Surety Bond And , as surety, being a surety company authorized to do business in the state of texas, are bound to the texas department of insurance in the sum of ten thousand dollars ($10,000.00) as specified at 28 texas administrative code §19.705. said money is payable to the texas department of insurance for the use. Provide a surety bond of $10,000 or more, with the exact name of your agency listed as the sole principal of the bond. upload the public insurance adjuster bond form (form fin509) and a copy of the original bond form to your sircon application. let us know which contract you will use with your clients.

Texas Public Insurance Adjuster Licensing Surety Bond Insider To be bonded for texas public insurance adjuster services, an individual must obtain a $10,000 surety bond as part of the licensing requirements to ensure compliance with state regulations and protect clients from potential misconduct. Do i need a surety bond to be a public adjuster in texas? yes, texas law requires public adjusters to hold a $10,000 surety bond as financial protection for policyholders. this bond must be uploaded with your license application. The requirement for a public or independent adjuster bond in texas stems from the state's efforts to regulate the insurance adjusting profession and protect policyholders. the texas insurance code, specifically chapter 4102, governs the licensing and activities of public insurance adjusters, including the mandate for a surety bond. What is a texas public insurance adjuster bond? know the how to of acquiring a public insurance adjuster bond in texas! as a condition of the public insurance adjuster licensure, the texas insurance code chapter 4102 requires that all public insurance adjusters within the state furnish a surety bond.

Introduction To Georgia Public Adjuster Licensing Surety Bond Insider The requirement for a public or independent adjuster bond in texas stems from the state's efforts to regulate the insurance adjusting profession and protect policyholders. the texas insurance code, specifically chapter 4102, governs the licensing and activities of public insurance adjusters, including the mandate for a surety bond. What is a texas public insurance adjuster bond? know the how to of acquiring a public insurance adjuster bond in texas! as a condition of the public insurance adjuster licensure, the texas insurance code chapter 4102 requires that all public insurance adjusters within the state furnish a surety bond. What is a texas public insurance adjuster bond? texas administrative code section 19.705 requires individuals file a $10,000 surety bond to be licensed as a public insurance adjuster. state form fin509 is officially titled the “public insurance adjuster bond” but is also known as the “public adjuster bond” or “insurance adjuster bond. A texas public adjuster bond is required by the statute from all applicants for a state issued license. the surety bond must be issued in the amount of ten thousand dollars ($10,000) and run to the texas department of insurance. The texas public insurance adjuster bond states that the bond holder will engage in business as a public insurance adjuster in accordance with the texas insurance code. additional requirements for a public insurance adjuster license. To receive a license in texas, public insurance adjusters need to file a $10,000 surety bond as a contingency plan to compensate those who may suffer financial damages. the public adjuster bond covers damages caused by the adjuster’s unfair practice, negligence, and errors or omissions when negotiating or effecting settlements or loss for.

Florida Public Adjuster Licensing A 2017 Guide Surety Bond Insider What is a texas public insurance adjuster bond? texas administrative code section 19.705 requires individuals file a $10,000 surety bond to be licensed as a public insurance adjuster. state form fin509 is officially titled the “public insurance adjuster bond” but is also known as the “public adjuster bond” or “insurance adjuster bond. A texas public adjuster bond is required by the statute from all applicants for a state issued license. the surety bond must be issued in the amount of ten thousand dollars ($10,000) and run to the texas department of insurance. The texas public insurance adjuster bond states that the bond holder will engage in business as a public insurance adjuster in accordance with the texas insurance code. additional requirements for a public insurance adjuster license. To receive a license in texas, public insurance adjusters need to file a $10,000 surety bond as a contingency plan to compensate those who may suffer financial damages. the public adjuster bond covers damages caused by the adjuster’s unfair practice, negligence, and errors or omissions when negotiating or effecting settlements or loss for.

.png?auto=compress,format)

How To Get A Texas Public Insurance Adjuster License Suretybonds The texas public insurance adjuster bond states that the bond holder will engage in business as a public insurance adjuster in accordance with the texas insurance code. additional requirements for a public insurance adjuster license. To receive a license in texas, public insurance adjusters need to file a $10,000 surety bond as a contingency plan to compensate those who may suffer financial damages. the public adjuster bond covers damages caused by the adjuster’s unfair practice, negligence, and errors or omissions when negotiating or effecting settlements or loss for.

How To Get A Texas Public Insurance Adjuster License Suretybonds