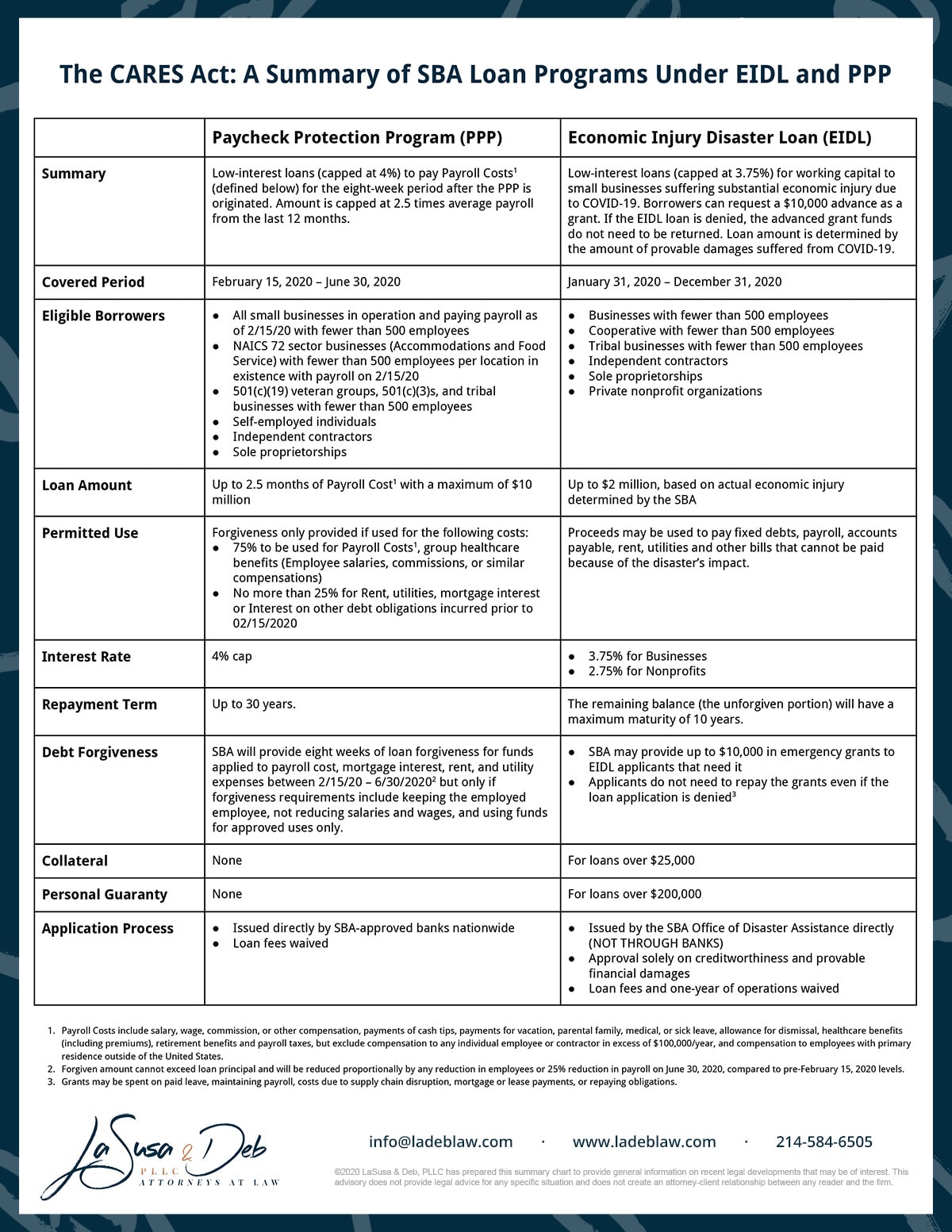

The Cares Act A Summary Of Sba Loan Programs Under Ppp And Eidl The coronavirus aid, relief, and economic security act (cares act) makes important changes to the small business administration (sba) economic impact disaster loan (eidl) program and creates the paycheck protection program (ppp). both programs provide potential financing options for small businesses impacted by the covid 19 emergency. The coronavirus aid, relief, and economic security act (cares act) makes important changes to the small business administration (sba) economic impact disaster loan (eidl) program and creates the paycheck protection program (ppp).

Sba Loan Programs Eidl Program Guide Pa Nj Md After exhausting the funding within 2 weeks, on april 24, 2020, the paycheck protection program and health care enhancement act added $310 billion of funding for loans to be made under the ppp, $60 billion of which is set aside for ppp loans from small banks, community financial institutions, and credit unions. Economic injury disaster loan (eidl) paycheck protection program (ppp) summary low interest loans for working capital to small businesses suffering substantial economic injury due to covid 19. borrowers can request $10,000 payable three days after application. if the eidl loan is denied, the advanced funds do not need to be returned. Question: how does the ppp loan coordinate with sba’s existing loans? answer: borrowers may apply for ppp loans and other sba financial assistance, including economic injury disaster loans (eidls), 7(a) loans, 504 loans, and microloans, and also receive. The cares act authorizes $349 billion for the ppp, for loans made by lenders in the sba's section 7(a) loan program and other lenders approved by the sba to qualifying small.

Cares Act Sba Eidl Ppp Loans Canal Capital Management Question: how does the ppp loan coordinate with sba’s existing loans? answer: borrowers may apply for ppp loans and other sba financial assistance, including economic injury disaster loans (eidls), 7(a) loans, 504 loans, and microloans, and also receive. The cares act authorizes $349 billion for the ppp, for loans made by lenders in the sba's section 7(a) loan program and other lenders approved by the sba to qualifying small. Below is a summary of loan programs of interest to institutions of higher education in the “coronavirus aid, relief, and economic security (cares) act.” the paycheck protection program (ppp) and economic injury disaster loans (eidl) are available to private, 501(c)3 organizations with fewer than 500 employees. Loan programs. businesses are permitted to participate in two major sba loan programs, the economic injury disaster loan program and the newly enacted paycheck protection program made available through the cares act, both of which are summarized below. eligible small businesses can qualify for both loan programs. In addition to the eidl expansion, the cares act adds a new paycheck protection program (ppp) to the sba’s section 7 (a) lending program. the ppp offers loans of up to $10 million for businesses to maintain payroll and related benefits, interest on mortgages and other debts, leases and utility payments. The paycheck protection program (“ppp”) is a nearly $350 billion program in the cares act intended to provide american small businesses with eight weeks of cash flow assistance through 100 percent federally guaranteed loans. the program is to be managed through the small business administration (“sba”).

Webinar Sba Eidl And Ppp Loan Guidance Below is a summary of loan programs of interest to institutions of higher education in the “coronavirus aid, relief, and economic security (cares) act.” the paycheck protection program (ppp) and economic injury disaster loans (eidl) are available to private, 501(c)3 organizations with fewer than 500 employees. Loan programs. businesses are permitted to participate in two major sba loan programs, the economic injury disaster loan program and the newly enacted paycheck protection program made available through the cares act, both of which are summarized below. eligible small businesses can qualify for both loan programs. In addition to the eidl expansion, the cares act adds a new paycheck protection program (ppp) to the sba’s section 7 (a) lending program. the ppp offers loans of up to $10 million for businesses to maintain payroll and related benefits, interest on mortgages and other debts, leases and utility payments. The paycheck protection program (“ppp”) is a nearly $350 billion program in the cares act intended to provide american small businesses with eight weeks of cash flow assistance through 100 percent federally guaranteed loans. the program is to be managed through the small business administration (“sba”).

Cares Act Guide Sba Halts Ppp Loan Application Submittals In addition to the eidl expansion, the cares act adds a new paycheck protection program (ppp) to the sba’s section 7 (a) lending program. the ppp offers loans of up to $10 million for businesses to maintain payroll and related benefits, interest on mortgages and other debts, leases and utility payments. The paycheck protection program (“ppp”) is a nearly $350 billion program in the cares act intended to provide american small businesses with eight weeks of cash flow assistance through 100 percent federally guaranteed loans. the program is to be managed through the small business administration (“sba”).

Comparing The Eidl And Ppp Loans Under The Cares Act