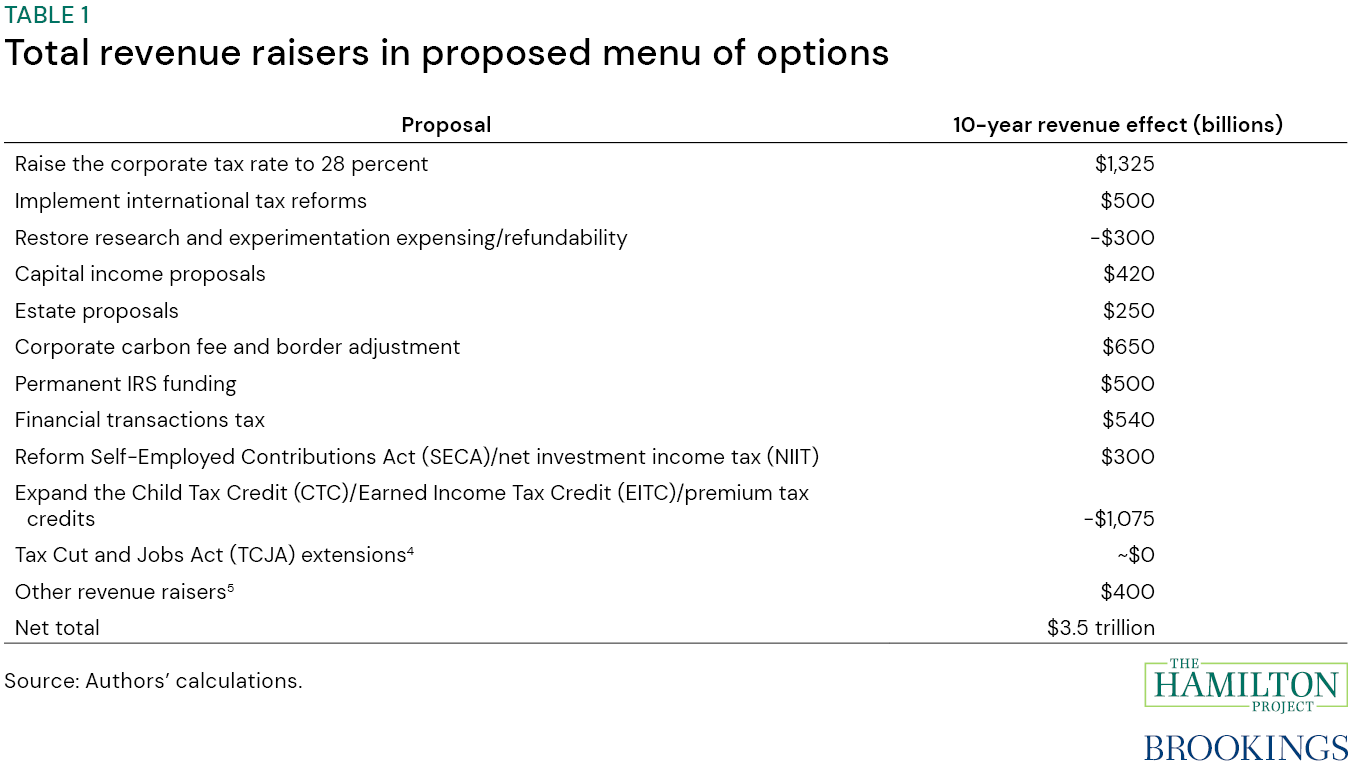

The Coming Fiscal Cliff A Blueprint For Tax Reform In 2025 The expiration of tax cuts and jobs act provisions at the end of 2025 presents an opportunity to improve tax policy. natasha sarin and kimberly clausing suggest key principles to guide tax. Tax reform in 2025 with the goals of raising revenue, increasing progressivity, enhancing efficiency, and improving global cooperation. should policymakers.

The Coming Fiscal Cliff A Blueprint For Tax Reform In 2025 Many provisions in the 2017 tax cuts and jobs act (tcja) are scheduled to expire at the end of 2025. policymakers will face significant pressure to extend at least some of the expiring tcja provisions, and will encounter important fiscal trade offs. The 2025 tax debate — prompted by a looming tax cliff — is underway. 1 many tax provisions will expire at the end of 2025, generally resulting from the sunsetting of most individual tax provisions and some business provisions in the tax cuts and jobs act. 2 the joint committee on taxation projects that extending the tcja would increase. The coming fiscal cliff: a blueprint for tax reform in 2025 (with natasha sarin), hamilton project paper (september 2023). full text the u.s. perspective on international tax law, in the oxford handbook of international tax law (2023). Like the corporate tax cuts in tcja, pass reduction in the domestic statutory tax rate from 35 through tax cuts work to lower the overall tax bur percent to 21 percent, were permanent, the tcja also den on capital, reducing the progressivity of the tax 37 embedded five corporate tax increases that take place system.

The Coming Fiscal Cliff A Blueprint For Tax Reform In 2025 The coming fiscal cliff: a blueprint for tax reform in 2025 (with natasha sarin), hamilton project paper (september 2023). full text the u.s. perspective on international tax law, in the oxford handbook of international tax law (2023). Like the corporate tax cuts in tcja, pass reduction in the domestic statutory tax rate from 35 through tax cuts work to lower the overall tax bur percent to 21 percent, were permanent, the tcja also den on capital, reducing the progressivity of the tax 37 embedded five corporate tax increases that take place system. At the end of 2025, almost all of the individual, estate, and pass through provisions of the tax cuts and jobs act (tcja) will expire. this looming expiration creates an important opportunity to improve tax policy along multiple dimensions at the same time that tcja provisions are evaluated for possible extension. in this paper, we suggest four key principles to guide tax policy choices in. Without action by lawmakers, changes to marginal tax rates and brackets, itemized deductions, tax exemptions, credits, and other portions of the federal tax system will expire at the end of december 2025. if extended, those individual income tax provisions would increase federal deficits by $2.5 trillion through 2034, according to cbo. All of this sets up the prospect of a massive fiscal cliff for the next white house and the next congress as they grapple with how to address the pending expiration of marquee tcja provisions,. In this paper, we suggest four key principles to guide tax policy choices in 2025: first, reforms should raise revenue on net, improving fiscal sustainability; second, reforms should respond to persistent inequalities by increasing the progressivity of the tax code; third, reforms should work to reduce tax based inefficiencies in the code, and.

The Coming Fiscal Cliff A Blueprint For Tax Reform In 2025 At the end of 2025, almost all of the individual, estate, and pass through provisions of the tax cuts and jobs act (tcja) will expire. this looming expiration creates an important opportunity to improve tax policy along multiple dimensions at the same time that tcja provisions are evaluated for possible extension. in this paper, we suggest four key principles to guide tax policy choices in. Without action by lawmakers, changes to marginal tax rates and brackets, itemized deductions, tax exemptions, credits, and other portions of the federal tax system will expire at the end of december 2025. if extended, those individual income tax provisions would increase federal deficits by $2.5 trillion through 2034, according to cbo. All of this sets up the prospect of a massive fiscal cliff for the next white house and the next congress as they grapple with how to address the pending expiration of marquee tcja provisions,. In this paper, we suggest four key principles to guide tax policy choices in 2025: first, reforms should raise revenue on net, improving fiscal sustainability; second, reforms should respond to persistent inequalities by increasing the progressivity of the tax code; third, reforms should work to reduce tax based inefficiencies in the code, and.

Fillable Online The Coming Fiscal Cliff A Blueprint For Tax Reform In All of this sets up the prospect of a massive fiscal cliff for the next white house and the next congress as they grapple with how to address the pending expiration of marquee tcja provisions,. In this paper, we suggest four key principles to guide tax policy choices in 2025: first, reforms should raise revenue on net, improving fiscal sustainability; second, reforms should respond to persistent inequalities by increasing the progressivity of the tax code; third, reforms should work to reduce tax based inefficiencies in the code, and.