These Stocks Are Forming The Winning Golden Cross Pattern There's more upside ahead for a select handful of stocks, according to a price chart pattern closely watched by technical analysts as a bullish signal. the phenomenon, known as a "golden. Benefits of golden cross in stocks. golden cross’s strategy comes with the following benefits. 1. predicts bullish trends. the golden cross in day trading indicates a bullish market when the short term 50 day average moves above the long term 200 day average. this shows strong upward momentum and suggests a possible potential price growth.

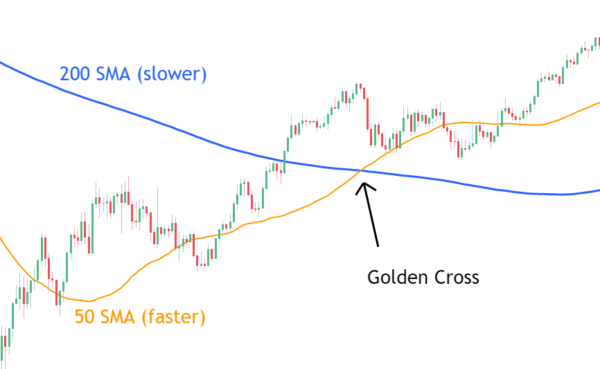

Golden Cross Pattern Explained In this article, we’ll uncover one of the most important and popular setups using moving averages – the golden cross. we’ll provide an explanation of the signal and then dive into three trading examples. what is a golden cross? a golden cross occurs when a faster moving average crosses a slower moving average. sounds simple enough right?. Both the golden cross and the death cross are lagging indicators. they are based on historical price data and may signal a trend change after the new trend has actually begun. this lag can result in traders entering positions later than optimal, potentially missing a significant portion of the trend. Historical data reveals the golden cross as a reliable indicator of bullish market conditions. for instance, analysis of the s&p 500 has shown that following a golden cross event, the market tends to perform positively in the long term. since 1950, occurrences of the golden cross have often led to an average return of about 10% a year later. An indication of a possible bullish trend reversal or continuation of the current bullish trend is the presence of the golden cross in a technical chart, which is seen as a positive indicator. when investors see the term "golden cross," it's a great chance to get in on the long side and profit from price increases. .

Golden Cross Pattern Explained Trading Technical Analysis Historical data reveals the golden cross as a reliable indicator of bullish market conditions. for instance, analysis of the s&p 500 has shown that following a golden cross event, the market tends to perform positively in the long term. since 1950, occurrences of the golden cross have often led to an average return of about 10% a year later. An indication of a possible bullish trend reversal or continuation of the current bullish trend is the presence of the golden cross in a technical chart, which is seen as a positive indicator. when investors see the term "golden cross," it's a great chance to get in on the long side and profit from price increases. . Mcdonald's and cisco systems are among the companies that have recently formed the "golden cross" pattern , a phenomenon that occurs when an asset's 50 day moving average rises above an. The golden cross is one of the most popular bullish signals in technical analysis. it occurs when a short term moving average crosses above a long term moving average, indicating a shift in the momentum of the price trend. the golden cross is often seen as a sign of a strong and sustained uptrend, and can attract more buyers to the market. The golden cross is a technical chart pattern that occurs when a short term moving average (sma) crosses above a long term moving average (lma), typically the 50 day moving average crossing above the 200 day moving average. this crossover signifies a potential shift in market momentum from bearish to bullish, indicating that the price of an. Technically speaking, a golden cross appears when a stock’s short term moving average goes above its long term moving average. when the golden cross shows up on a technical chart, it’s seen as a positive sign. this means that the market trend could change from negative to bullish or continue moving in a bullish direction.

Golden Cross Pattern Explained Trading Technical Analysis Mcdonald's and cisco systems are among the companies that have recently formed the "golden cross" pattern , a phenomenon that occurs when an asset's 50 day moving average rises above an. The golden cross is one of the most popular bullish signals in technical analysis. it occurs when a short term moving average crosses above a long term moving average, indicating a shift in the momentum of the price trend. the golden cross is often seen as a sign of a strong and sustained uptrend, and can attract more buyers to the market. The golden cross is a technical chart pattern that occurs when a short term moving average (sma) crosses above a long term moving average (lma), typically the 50 day moving average crossing above the 200 day moving average. this crossover signifies a potential shift in market momentum from bearish to bullish, indicating that the price of an. Technically speaking, a golden cross appears when a stock’s short term moving average goes above its long term moving average. when the golden cross shows up on a technical chart, it’s seen as a positive sign. this means that the market trend could change from negative to bullish or continue moving in a bullish direction.

Golden Cross Pattern Explained Trading Technical Analysis The golden cross is a technical chart pattern that occurs when a short term moving average (sma) crosses above a long term moving average (lma), typically the 50 day moving average crossing above the 200 day moving average. this crossover signifies a potential shift in market momentum from bearish to bullish, indicating that the price of an. Technically speaking, a golden cross appears when a stock’s short term moving average goes above its long term moving average. when the golden cross shows up on a technical chart, it’s seen as a positive sign. this means that the market trend could change from negative to bullish or continue moving in a bullish direction.

Golden Cross Pattern Explained Trading Technical Analysis