These Stocks Are Forming The Bullish Golden Cross Chart Pattern A golden cross predicts a bullish trend for stocks and other securities. learn more about how to use golden cross stocks. view which stocks have had recent "golden crosses," which occur when a stock's 50 day moving average crosses above its 200 day moving average. These stocks are forming the bullish 'golden cross' chart pattern. as august comes to a close, a handful of stocks are on the verge of an upward breakout, according to this chart.

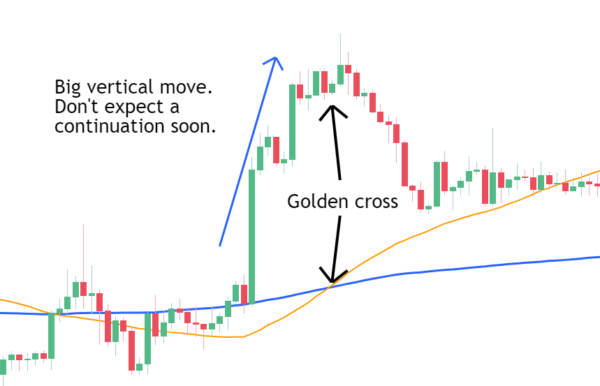

107273825 16897916582023 07 19t172356z 2123467077 Rc2d62a15xey Rtrmadp The golden cross is a well known technical indicator used by traders and investors. it is a bullish chart pattern that indicates the reversal of a downtrend. specifically, a golden cross forms when a stock's 50 day moving average price crosses over its 200 day moving average. Discover how silver and golden cross patterns signal bullish momentum in stocks. learn simple strategies to identify these technical moves and explore trading ideas with clorox,. A golden crossover is used in the technical analysis of financial markets to describe a bullish move that occurs when a shorter term moving average crosses above a longer term moving average. the most common moving averages used are the 50 day moving average (short term) and the 200 day moving average (long term). A golden crossover is used in technical analysis of financial markets to describe a bullish move that occurs when a shorter term moving average crosses above a longer term moving average. the most common moving averages used are the 50 day moving average (short term) and the 200 day moving average (long term).

107311434 1696431553970 Gettyimages 1716916366 Img 4641 Q39sqyl9 Jpeg V A golden crossover is used in the technical analysis of financial markets to describe a bullish move that occurs when a shorter term moving average crosses above a longer term moving average. the most common moving averages used are the 50 day moving average (short term) and the 200 day moving average (long term). A golden crossover is used in technical analysis of financial markets to describe a bullish move that occurs when a shorter term moving average crosses above a longer term moving average. the most common moving averages used are the 50 day moving average (short term) and the 200 day moving average (long term). Benefits of golden cross in stocks. golden cross’s strategy comes with the following benefits. 1. predicts bullish trends. the golden cross in day trading indicates a bullish market when the short term 50 day average moves above the long term 200 day average. this shows strong upward momentum and suggests a possible potential price growth. The golden cross is a bullish chart pattern that occurs when a short term moving average crosses above a long term moving average. this crossover signals the potential for an upward trend, indicating that the market may be transitioning from a bearish phase to a bullish one. The golden cross chart pattern forms when a short term moving average crosses above a long term moving average, signalling a bullish trend’s continuation. the most commonly used representation of the golden cross chart is when a 50 day moving average crosses over the 200 day moving average. A golden cross is a bullish indicator that’s seen in a stock chart when the short term moving average moves above the long term moving average. learn more.

Dow Other Key Stocks Form Bullish Golden Cross Benefits of golden cross in stocks. golden cross’s strategy comes with the following benefits. 1. predicts bullish trends. the golden cross in day trading indicates a bullish market when the short term 50 day average moves above the long term 200 day average. this shows strong upward momentum and suggests a possible potential price growth. The golden cross is a bullish chart pattern that occurs when a short term moving average crosses above a long term moving average. this crossover signals the potential for an upward trend, indicating that the market may be transitioning from a bearish phase to a bullish one. The golden cross chart pattern forms when a short term moving average crosses above a long term moving average, signalling a bullish trend’s continuation. the most commonly used representation of the golden cross chart is when a 50 day moving average crosses over the 200 day moving average. A golden cross is a bullish indicator that’s seen in a stock chart when the short term moving average moves above the long term moving average. learn more.

16 Breakout Stocks Are Forming The Bullish Golden Cross Chart Pattern The golden cross chart pattern forms when a short term moving average crosses above a long term moving average, signalling a bullish trend’s continuation. the most commonly used representation of the golden cross chart is when a 50 day moving average crosses over the 200 day moving average. A golden cross is a bullish indicator that’s seen in a stock chart when the short term moving average moves above the long term moving average. learn more.

The 3 Best Strategies To Trade The Golden Cross Pattern Living From