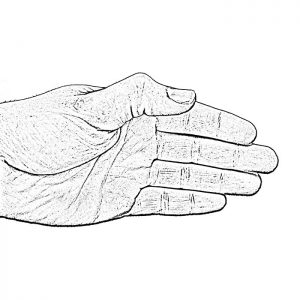

Thumb Mcp Instability

Orthotic Fabrication For Mcp Joint Instability Decentralized finance (defi) markets spread across layer 1 (l1) and layer 2 (l2) blockchains rely on arbitrage to keep prices aligned. today most price gaps are closed against centralized exchanges (cexes), whose deep liquidity and fast execution make them the primary venue for price discovery. as trading volume migrates on chain, cross chain arbitrage between decentralized exchanges (dexes. A cross sectional analysis and operation of crypto arbitrage can be found in the study by borri and shakhnov (2022). however, such exchange arbitrage is limited by the fund transfer time on a certain blockchain and a cryptocurrency exchange’s processing time.

Orthotic Fabrication For Mcp Joint Instability This work resolves the stablecoin trilemma through a novel synthesis of cryptographic primitives, algorithmic incentives, and cross chain interoperability. by tying stabilization futures contracts (sfcs) to price deviation metrics, we create a self reinforcing equilibrium where rational arbitrageurs profit by stabilizing the peg a mechanism. Stablecoins face an unresolved trilemma of balancing decentralization, stability, and regulatory compliance. we present a hybrid stabilization protocol that combines crypto collateralized reserves, algorithmic futures contracts, and cross chain liquidity pools to achieve robust price adherence while preserving user privacy. at its core, the protocol introduces stabilization futures contracts. Decentralized exchanges (dexes) enable users to create markets for exchanging any pair of cryptocurrencies. the direct exchange rate of two tokens may not match the cross exchange rate in the market, and such price discrepancies open up arbitrage possibilities with trading through different cryptocurrencies cyclically. in this paper, we conduct a systematic investigation on cyclic arbitrages. However, existing stablecoin designs are tied to individual blockchain platforms, and trusted parties or complex protocols are needed to exchange stablecoin tokens between blockchains. our goal is to design a practical stablecoin for cross chain commerce. realizing this goal requires addressing two challenges.

Orthotic Fabrication For Mcp Joint Instability Decentralized exchanges (dexes) enable users to create markets for exchanging any pair of cryptocurrencies. the direct exchange rate of two tokens may not match the cross exchange rate in the market, and such price discrepancies open up arbitrage possibilities with trading through different cryptocurrencies cyclically. in this paper, we conduct a systematic investigation on cyclic arbitrages. However, existing stablecoin designs are tied to individual blockchain platforms, and trusted parties or complex protocols are needed to exchange stablecoin tokens between blockchains. our goal is to design a practical stablecoin for cross chain commerce. realizing this goal requires addressing two challenges. The eth stands for ether, which is the most popular cryptocurrency and usdt (tether) is a type of stablecoin, a cryptocurrency designed to maintain a stable value by being pegged to us dollar (usd). This work resolves the stablecoin trilemma through a novel synthesis of cryptographic primitives, algorithmic incentives, and cross chain interoperability. by tying stabilization futures contracts (sfcs) to price devi ation metrics, we create a self reinforcing equilibrium where rational arbitrageurs profit by stabilizing the peg a mechanism. Cross chain arbitrage is mainly lucrative to actors who can mini mize execution risks—especially latency—and manage inventory across chains. sequencing control addresses the first challenge: an entity that determines block order on several chains can ensure its multi chain transaction bundle lands exactly as intended. Purpose — this research aims to demonstrate a dynamic cointegration based pairs trading strategy, including an optimal look back window framework in the cryptocurrency market, and evaluate its return and risk by applying three different scenarios.

Thumb Mcp Dislocation S63 116a 834 01 Eorif The eth stands for ether, which is the most popular cryptocurrency and usdt (tether) is a type of stablecoin, a cryptocurrency designed to maintain a stable value by being pegged to us dollar (usd). This work resolves the stablecoin trilemma through a novel synthesis of cryptographic primitives, algorithmic incentives, and cross chain interoperability. by tying stabilization futures contracts (sfcs) to price devi ation metrics, we create a self reinforcing equilibrium where rational arbitrageurs profit by stabilizing the peg a mechanism. Cross chain arbitrage is mainly lucrative to actors who can mini mize execution risks—especially latency—and manage inventory across chains. sequencing control addresses the first challenge: an entity that determines block order on several chains can ensure its multi chain transaction bundle lands exactly as intended. Purpose — this research aims to demonstrate a dynamic cointegration based pairs trading strategy, including an optimal look back window framework in the cryptocurrency market, and evaluate its return and risk by applying three different scenarios. We search for token transfers occurring between the two legs of an arbitrage and link them based on matching sender and receiver addresses involved in the detected cross chain arbitrage. Tether (usdt), launched in 2014 by tether limited, stands as the most widely adopted stablecoin, maintaining a 1:1 peg with the u.s. dollar. usdt's prominent place in the cryptocurrency market is recognized by its substantial market capitalization and trading volume.

Thumb Mcp Problems Silver Ring Splint Cross chain arbitrage is mainly lucrative to actors who can mini mize execution risks—especially latency—and manage inventory across chains. sequencing control addresses the first challenge: an entity that determines block order on several chains can ensure its multi chain transaction bundle lands exactly as intended. Purpose — this research aims to demonstrate a dynamic cointegration based pairs trading strategy, including an optimal look back window framework in the cryptocurrency market, and evaluate its return and risk by applying three different scenarios. We search for token transfers occurring between the two legs of an arbitrage and link them based on matching sender and receiver addresses involved in the detected cross chain arbitrage. Tether (usdt), launched in 2014 by tether limited, stands as the most widely adopted stablecoin, maintaining a 1:1 peg with the u.s. dollar. usdt's prominent place in the cryptocurrency market is recognized by its substantial market capitalization and trading volume.

Thumb Mcp Problems Artofit We search for token transfers occurring between the two legs of an arbitrage and link them based on matching sender and receiver addresses involved in the detected cross chain arbitrage. Tether (usdt), launched in 2014 by tether limited, stands as the most widely adopted stablecoin, maintaining a 1:1 peg with the u.s. dollar. usdt's prominent place in the cryptocurrency market is recognized by its substantial market capitalization and trading volume.

Comments are closed.