Trade Finance 4 Blog Creative Presentations Ideas Who benefits from trade finance? smes, large corporations, and even governments use trade finance to achieve a range of growth goals. this could include increasing the size and scope of the goods and services they trade in, scaling up their global operations, or helping them fulfil large contracts. Trade finance syncs global trade by facilitating smooth transactions for businesses by allowing greater control of cash flow, providing working capital between importers and exporters, and expanding market reach.

Trade Finance Products 3 Types You Should Know About Statrys Trade finance products are essential in facilitating international trade, helping businesses mitigate risks and improve cash flow in cross border transactions. Trade finance is essential for businesses engaging in international trade, providing financial tools to mitigate risks, enhance liquidity, and facilitate transactions. it includes various instruments such as letters of credit and bank guarantees. What are the benefits of trade financing? trade finance products support economic development by enabling companies to sustain operations during the production and delivery of goods. other benefits include: improve cash flow management. trade financing allows businesses to manage their cash flow better. Trade finance can help businesses to get products to market more quickly, expand their operations into new markets, and create jobs. in order to qualify for trade finance, businesses need to demonstrate that they are creditworthy and that the goods they are importing or exporting are legitimate.

3 Common Types Of Trade Finance Products Explained Statrys What are the benefits of trade financing? trade finance products support economic development by enabling companies to sustain operations during the production and delivery of goods. other benefits include: improve cash flow management. trade financing allows businesses to manage their cash flow better. Trade finance can help businesses to get products to market more quickly, expand their operations into new markets, and create jobs. in order to qualify for trade finance, businesses need to demonstrate that they are creditworthy and that the goods they are importing or exporting are legitimate. Trade finance products are financial tools designed to facilitate international trade transactions. they address common challenges, such as non payment and cash flow gaps, ensuring a secure and successful experience for both importers and exporters. how can trade finance products benefit your business? here's how they can help your business. Trade financing is the practice of providing funding or credit assurances to businesses engaged in international trade. trade financing helps these businesses bridge the financial gap to cover expenses like goods, shipping, and other related services for a successful international transaction. Trade financing gives exporters receivables or payment when agreed upon, while importers may receive credit to fulfil trade orders. this essentially removes the payment and supply risks by involving a third party.

3 Common Types Of Trade Finance Products Explained Statrys Trade finance products are financial tools designed to facilitate international trade transactions. they address common challenges, such as non payment and cash flow gaps, ensuring a secure and successful experience for both importers and exporters. how can trade finance products benefit your business? here's how they can help your business. Trade financing is the practice of providing funding or credit assurances to businesses engaged in international trade. trade financing helps these businesses bridge the financial gap to cover expenses like goods, shipping, and other related services for a successful international transaction. Trade financing gives exporters receivables or payment when agreed upon, while importers may receive credit to fulfil trade orders. this essentially removes the payment and supply risks by involving a third party.

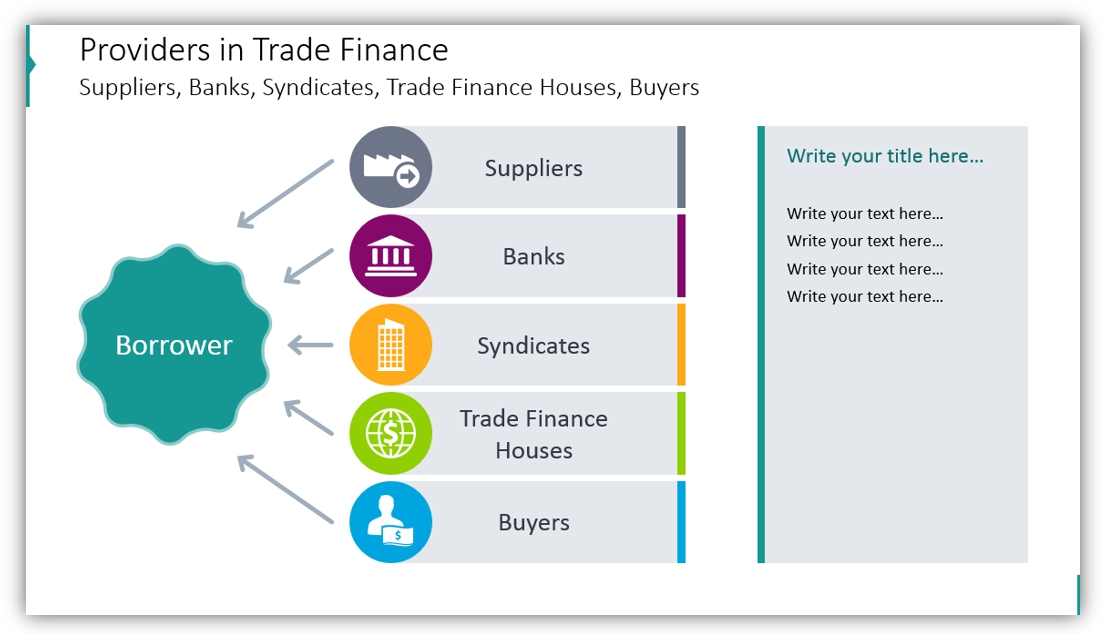

Trade Finance Servcred Microbanco Trade financing gives exporters receivables or payment when agreed upon, while importers may receive credit to fulfil trade orders. this essentially removes the payment and supply risks by involving a third party.