Turning 55 Soon Here S How You Can Use Cpf As Your Personal Savings Being near the age of 55, we can deploy the cpf shielding hack by investing our sa in a low cost and liquid fund offered on the cpf investment scheme (cpfis). once we turn 55, our oa monies and unshielded sa monies will be used to fund our ra but our shielded sa balances will remain accessible once we redeem our investment. Do you know that once you have met your frs, you can also withdraw your cpf savings as often as you like from age 55? this gives you the flexibility to access your money in the event of emergencies.

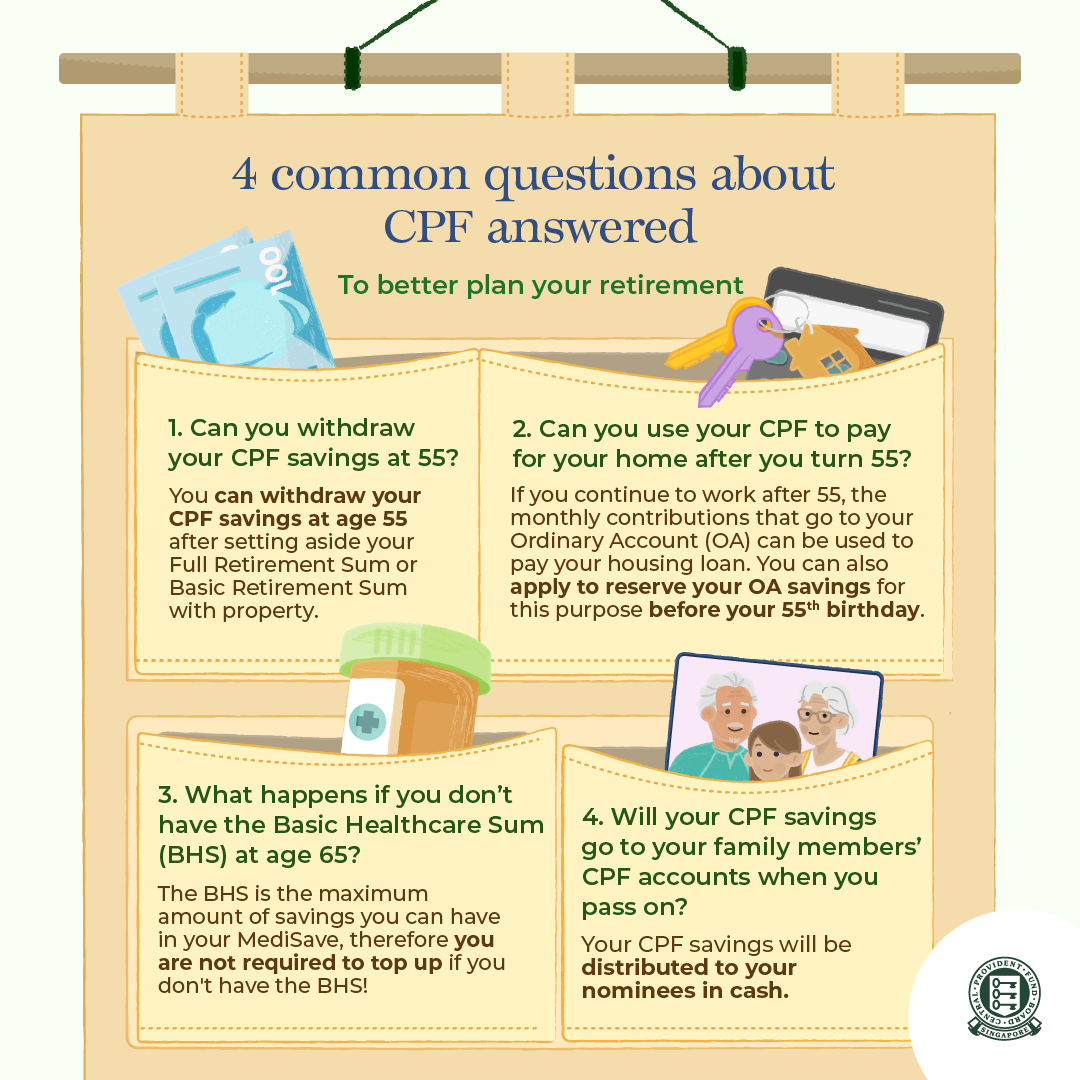

Cpfb Can You Withdraw Your Cpf At 55 When you turn 55, we will transfer your cpf savings, up to your full retirement sum (frs), to create your retirement account (ra) and close your special account (sa). your sa savings will be transferred first, followed by your ordinary account (oa) savings. When you reach age 55, your cpf savings will be transferred from your special account, followed by your ordinary account to your retirement account up to your full retirement sum (frs). savings above your frs will remain in your ordinary account and are withdrawable. Here are three ways to top up cpf after reaching age 55: top ups under retirement sum topping up (rstu) scheme: use cash to top up to retirement account to meet the current full retirement sum. Cpf members can make withdrawals from their cpf savings starting from age 55. generally, upon turning 55, members can withdraw at least $5,000 or any amount in excess after setting aside their full retirement sum (frs). members born in 1958 and after can withdraw an additional amount of up to 20% of their retirement savings when they turn 65.

Cpfb Can You Withdraw Your Cpf At 55 Here are three ways to top up cpf after reaching age 55: top ups under retirement sum topping up (rstu) scheme: use cash to top up to retirement account to meet the current full retirement sum. Cpf members can make withdrawals from their cpf savings starting from age 55. generally, upon turning 55, members can withdraw at least $5,000 or any amount in excess after setting aside their full retirement sum (frs). members born in 1958 and after can withdraw an additional amount of up to 20% of their retirement savings when they turn 65. When you reach 55, savings from your sa, followed by savings from your oa, will be transferred to create your ra to fill up to the frs. any balance that remains in your oa can be used for your housing loan repayments. By now, most singaporeans should be aware that their cpf special account (sa) will be closed when they turn 55. their sa savings will be transferred to their retirement account (ra), up to the full retirement sum (frs) or basic retirement sum (brs). any remaining sa savings will be transferred to their ordinary account (oa). At 55, for anyone born in 1958 or after, you can withdraw up to s$5,000 unconditionally from your cpf savings. this amount will be withdrawn from your oa and sa. if you already have your frs in. Turning 55 soon? 🕒 big changes are coming to your cpf special account starting in 2025. let's navigate these changes together to ensure your retirement savings are working hard for you. discover what these updates mean and how you can make informed decisions for a secure, worry free retirement. 💼📊.