What Does Volume Profile Tell You Volume Profile Trading Trading Volume profile is a technical analysis tool that displays the volume of trading activity at different prices for a given security. it can be used to identify trading opportunities by identifying areas of high and low volume. high volume indicates strong interest in a security, while low volume indicates lack of interest. A volume profile indicator is simply a graphical representation of how much volume (or liquidity) is present at different prices within a given time period. the indicator can be used to identify potential areas of support and resistance, as well as potential trading opportunities.

Beginners Guide To Volume Profile Part 3 Where To Get Volume Profile A volume profile is an advanced charting indicator that displays total volume traded at every price level over a user specified time period. volume profiles uses: identify key support and resistance levels for setups; determine logical take profits and stop losses; calculate initial r multiplier; identify balanced vs imbalanced markets. The exact definition of volume profile and why it outperforms basic volume analysis; the three critical types of volume profiles and when to apply each one; professionally tested strategies using point of control (poc) and value areas; the best free and paid volume profile tools for tradingview, metatrader, and ninjatrader. In the stock market, a volume profile is a graphical representation of the traded volume at various price levels over a predetermined time period. it gives traders information about areas where there has been a lot of trading activity, which aids in identifying important resistance as well as support levels. Volume profile a complete guide (with trading examples!) preview. 8 hours ago a volume profile is an advanced charting indicator that displays total volume traded at every price level over a user specified time period. volume profiles uses: 1. identify key support and resistance levels for setups 2.

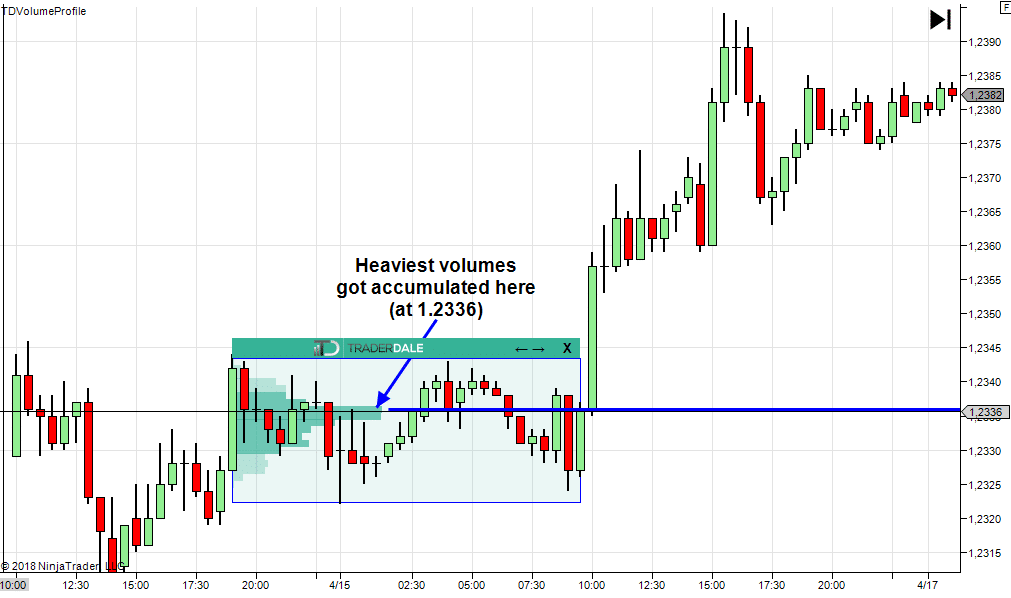

Beginners Guide To Volume Profile Part 2 Simple Volume Profile Trading In the stock market, a volume profile is a graphical representation of the traded volume at various price levels over a predetermined time period. it gives traders information about areas where there has been a lot of trading activity, which aids in identifying important resistance as well as support levels. Volume profile a complete guide (with trading examples!) preview. 8 hours ago a volume profile is an advanced charting indicator that displays total volume traded at every price level over a user specified time period. volume profiles uses: 1. identify key support and resistance levels for setups 2. Discover how to identify critical levels, analyze market sentiment, and implement winning trading strategies — all illustrated with real world examples to boost your skills. what is volume profile? 1. point of control (poc) 2. value area (va) 3. value area high (vah) and low (val) 4. high volume nodes (hvns) 5. low volume nodes (lvns) 1. The volume profile is created by plotting the volume traded at each price level on a chart. this allows traders to see where the most trading activity is taking place and make decisions accordingly. the volume profile can be used in a number of ways, but one common use is to help identify potential support and resistance levels. Throughout this article, there will be a full explanation of the volume profile, how to use this tool, and create a trading strategy from that. 1. what is the volume profile? 2. distribution theory. 3. creating a trading plan and levels. the volume profile is a simple trading tool that can be found on any software. Volume profile definition: volume profile is a trading indicator which shows volume at price. it helps to identify where the big financial institutions put their money and helps to reveal their intentions. what does volume profile look like? volume profile can have many shapes – depending on how the volumes were distributed.

Volume Profile Chartbook Collection Discover how to identify critical levels, analyze market sentiment, and implement winning trading strategies — all illustrated with real world examples to boost your skills. what is volume profile? 1. point of control (poc) 2. value area (va) 3. value area high (vah) and low (val) 4. high volume nodes (hvns) 5. low volume nodes (lvns) 1. The volume profile is created by plotting the volume traded at each price level on a chart. this allows traders to see where the most trading activity is taking place and make decisions accordingly. the volume profile can be used in a number of ways, but one common use is to help identify potential support and resistance levels. Throughout this article, there will be a full explanation of the volume profile, how to use this tool, and create a trading strategy from that. 1. what is the volume profile? 2. distribution theory. 3. creating a trading plan and levels. the volume profile is a simple trading tool that can be found on any software. Volume profile definition: volume profile is a trading indicator which shows volume at price. it helps to identify where the big financial institutions put their money and helps to reveal their intentions. what does volume profile look like? volume profile can have many shapes – depending on how the volumes were distributed.