Why Real Estate Won T Crash Like 2008 The housing market crash of 2008 remains one of the most significant events in the history of the united states housing market. it was caused by a combination of factors, including the subprime mortgage crisis, high levels of debt, and a lack of regulation in the financial sector. What caused the housing market crash of 2008? the housing market crash of 2008 was caused by a combination of factors, including subprime lending, overinflated housing prices, and risky financial practices such as mortgage backed securities.

Housing Market Crash 2008 Explained Causes And Effects Misperceptions about the key drivers and impacts of the 2008 housing crisis persist — and clarifying those will ensure the same mistakes aren't repeated, wharton experts say. The housing market crash of 2008 remains one of the most significant events in the history of the united states housing market. it was caused by a combination of factors, including the subprime mortgage crisis, high levels of debt, and a lack of regulation in the financial sector. The beginning of the stock market crash and housing banking crisis of 2008 marked a significant economic downturn in the united states, rooted in the unsustainable growth of the housing market from 2006 onward. The 2008 financial crisis and ensuing recession exposed palpable home precarities: the dramatic risks of purchasing decisions in a volatile, underregulated and unstable housing market. remarkably, despite the severe decline in access to mortgages, property tv’s logic of property ownership prospered in the aftermath of 2008.

Housing Market Crash 2008 Explained Causes And Effects The beginning of the stock market crash and housing banking crisis of 2008 marked a significant economic downturn in the united states, rooted in the unsustainable growth of the housing market from 2006 onward. The 2008 financial crisis and ensuing recession exposed palpable home precarities: the dramatic risks of purchasing decisions in a volatile, underregulated and unstable housing market. remarkably, despite the severe decline in access to mortgages, property tv’s logic of property ownership prospered in the aftermath of 2008. The current real estate downturn has been caused by: the post covid boom in demand inflating an already growing housing bubble. poor buyer confidence due to economic difficulties. we’re unlikely to see mass foreclosures or the financial system collapse due the real estate market. The housing market crash of 2008 reshaped the global economy, triggered by subprime mortgages, predatory lending, and lack of financial regulation, leading to a global economic recession. Explore the causes and impacts of the 2008 real estate market crash with an in depth look at the triggers and consequences for homeowners and investors. According to the final report of the national commission on the causes of the financial and economic crisis of the united states, between 2001 and 2007, mortgage debt rose nearly as much as it.

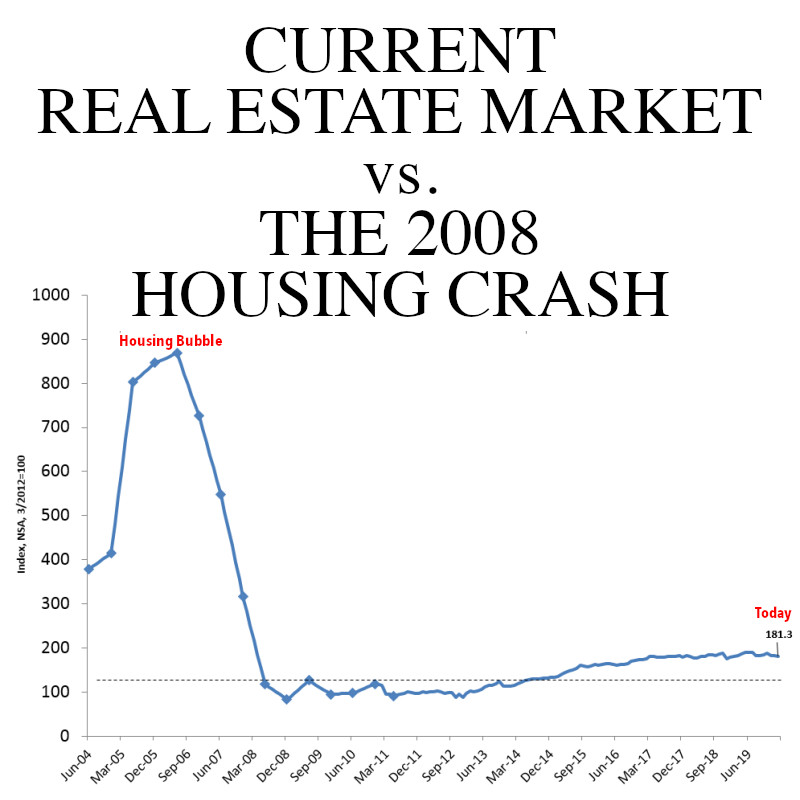

The Current Real Estate Market Vs The 2008 Housing Crash Delger Real The current real estate downturn has been caused by: the post covid boom in demand inflating an already growing housing bubble. poor buyer confidence due to economic difficulties. we’re unlikely to see mass foreclosures or the financial system collapse due the real estate market. The housing market crash of 2008 reshaped the global economy, triggered by subprime mortgages, predatory lending, and lack of financial regulation, leading to a global economic recession. Explore the causes and impacts of the 2008 real estate market crash with an in depth look at the triggers and consequences for homeowners and investors. According to the final report of the national commission on the causes of the financial and economic crisis of the united states, between 2001 and 2007, mortgage debt rose nearly as much as it.