Double Declining Depreciation Method In Accounting What is the double declining balance (ddb) depreciation method? the double declining balance (ddb) depreciation method, also known as the reducing balance method, is one of. The double declining balance method of depreciation, also known as the 200% declining balance method of depreciation, is a form of accelerated depreciation. this means that compared to the straight line method, the depreciation expense will be faster in the early years of the asset’s life but slower in the later years.

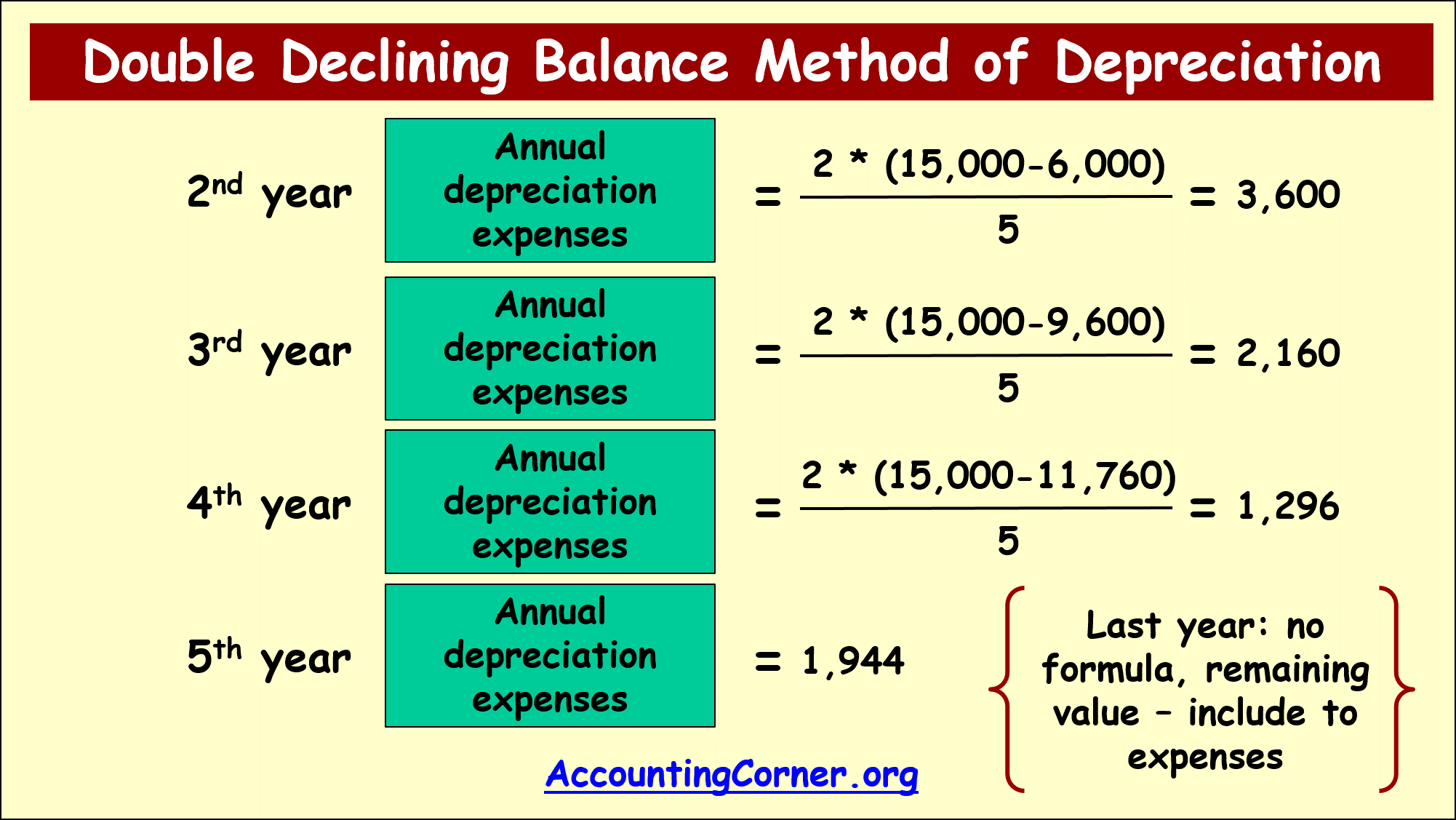

Double Declining Balance Method Of Depreciation Accounting Corner The double declining balance method (ddb) is a form of accelerated depreciation in which the annual depreciation expense is greater during the earlier stages of the fixed asset’s useful life. how the double declining balance depreciation method works. Unlike the straight line method, the double declining method depreciates a higher portion of the asset’s cost in the early years and reduces the amount of expense charged in later years. therefore, it is more suited to depreciating assets with a higher degree of wear and tear, usage, or loss of value earlier in their lives. The double declining balance (ddb) depreciation method is an accounting approach that involves depreciating certain assets at twice the rate outlined under straight line depreciation . The double declining balance method, often referred to as the ddb method, is a commonly used accounting technique to calculate the depreciation of an asset. this method falls under the category of accelerated depreciation methods, which means that it front loads the depreciation expenses, allowing for a larger deduction in the earlier years of.

Double Declining Balance Method Of Depreciation Accounting Corner The double declining balance (ddb) depreciation method is an accounting approach that involves depreciating certain assets at twice the rate outlined under straight line depreciation . The double declining balance method, often referred to as the ddb method, is a commonly used accounting technique to calculate the depreciation of an asset. this method falls under the category of accelerated depreciation methods, which means that it front loads the depreciation expenses, allowing for a larger deduction in the earlier years of. Among the various methods, the double declining balance method stands out for its accelerated depreciation approach, allowing businesses to write off assets more rapidly during their early years. the double declining balance method calculates depreciation by applying a constant rate to an asset’s declining book value. The double declining balance (ddb) method is notable for its accelerated approach to asset depreciation, impacting a company’s reported earnings and tax liabilities by front loading depreciation expenses. calculating double declining balance depreciation. What is double declining balance depreciation? the double declining balance method is an accelerated form of depreciation under which most of the depreciation associated with a fixed asset is recognized during the first few years of its useful life. how to calculate double declining balance depreciation. A double declining balance depreciation method is an accelerated depreciation method that can be used to depreciate the asset's value over the useful life. it is a bit more complex than the straight line method of depreciation but is useful for deferring tax payments and maintaining low profitability in the early years.

A Simple Guide To Double Declining Balance Method Among the various methods, the double declining balance method stands out for its accelerated depreciation approach, allowing businesses to write off assets more rapidly during their early years. the double declining balance method calculates depreciation by applying a constant rate to an asset’s declining book value. The double declining balance (ddb) method is notable for its accelerated approach to asset depreciation, impacting a company’s reported earnings and tax liabilities by front loading depreciation expenses. calculating double declining balance depreciation. What is double declining balance depreciation? the double declining balance method is an accelerated form of depreciation under which most of the depreciation associated with a fixed asset is recognized during the first few years of its useful life. how to calculate double declining balance depreciation. A double declining balance depreciation method is an accelerated depreciation method that can be used to depreciate the asset's value over the useful life. it is a bit more complex than the straight line method of depreciation but is useful for deferring tax payments and maintaining low profitability in the early years.

Double Declining Balance Method Of Depreciation Accounting Corner What is double declining balance depreciation? the double declining balance method is an accelerated form of depreciation under which most of the depreciation associated with a fixed asset is recognized during the first few years of its useful life. how to calculate double declining balance depreciation. A double declining balance depreciation method is an accelerated depreciation method that can be used to depreciate the asset's value over the useful life. it is a bit more complex than the straight line method of depreciation but is useful for deferring tax payments and maintaining low profitability in the early years.