What Is Ebitda Explained In A Minute

Learn About Ebitda Pdf Economies Money In this beginner friendly guide, we explain what ebitda means, how to calculate ebitda step by step, and why it matters in business valuation, mergers and acquisitions, and investment. Ebitda—which stands for earnings before interest, taxes, depreciation, and amortization—emerged in the 1970s when billionaire investor john malone started using it. today, it's become essential for business valuation and performance assessment.

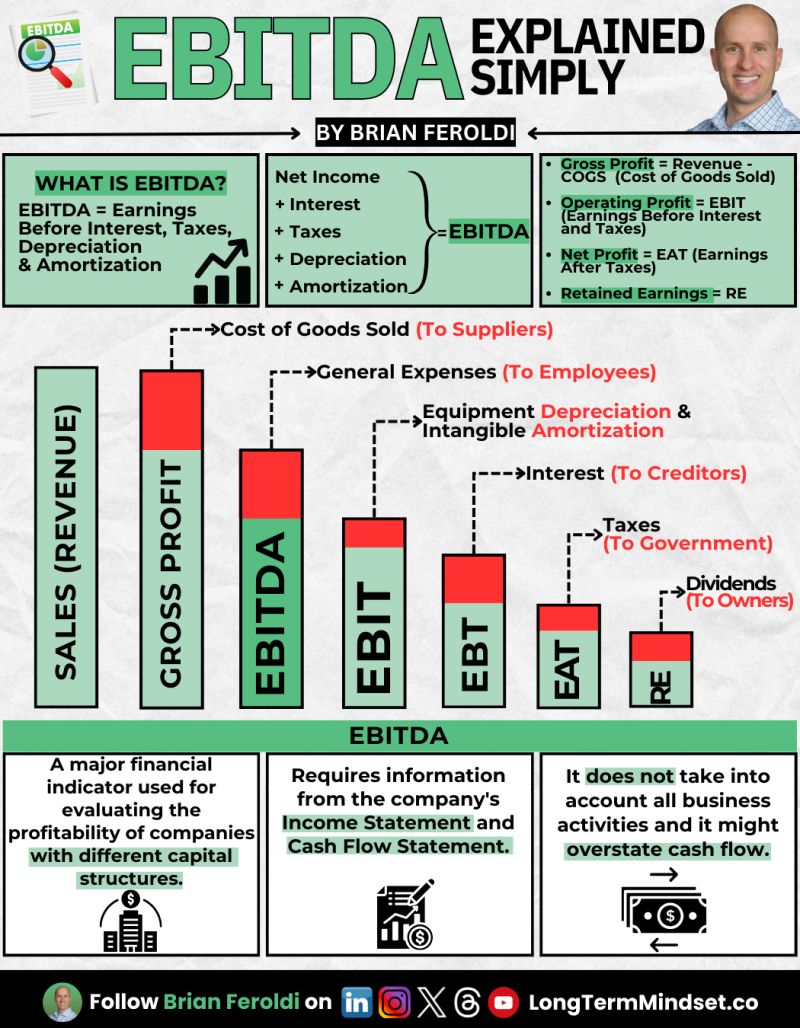

Ebitda Meaning Formula And History Pdf Depreciation Net Income A company's earnings before interest, taxes, depreciation and amortization (ebitda) is one way to measure profitability and financial performance. ebitda can be helpful for analyzing organizations over time and when comparing different businesses from the same industry because it removes variables that the companies might not be able to control, such as their tax rates. for small business. What is ebitda? ebitda stands for e arnings b efore i nterest, t axes, d epreciation, and a mortization and is a metric used to evaluate a company’s operating performance. it can be seen as a loose proxy for cash flow from the entire company’s operations. What is ebitda? ebitda stands for “earnings before interest, taxes, depreciation, and amortization.” think of it as looking at a company’s profits before certain expenses are taken out. Ebitda is an acronym for earnings before interest, taxes, depreciation, and amortization. ebitda is a major financial indicator used to evaluate companies' profitability with different capital structures.

Ebitda Explained In One Image Swipefile What is ebitda? ebitda stands for “earnings before interest, taxes, depreciation, and amortization.” think of it as looking at a company’s profits before certain expenses are taken out. Ebitda is an acronym for earnings before interest, taxes, depreciation, and amortization. ebitda is a major financial indicator used to evaluate companies' profitability with different capital structures. Ebitda, or earnings before interest, taxes, depreciation, and amortization, is a different measure of profitability than net income. ebitda, which includes depreciation and amortization as well as taxes and debt service expenses, seeks to depict the cash profit created by the company's activities. 00:06:08 what is ebitda? we explain it in 5 minutes or less. every week we pick an investing or business concept and explain it in a refreshingly simple way.…. Ebitda is an acronym that stands for earnings before interest, taxes, depreciation, and amortization. in other words, it tells you the earnings that a business has generated prior to any debt interest expenses, tax payments, and depreciation amortization costs of the business. Ebitda, an acronym for earnings before interest, taxes, depreciation, and amortization, is a financial metric that provides insights into a company's earnings without factoring in specific expenses.

Comments are closed.