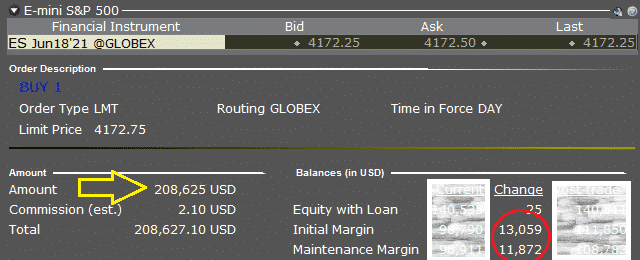

Futures Trading Video Training Series Leverage Insignia Futures Leverage in futures trading allows traders to control large contracts with a relatively small amount of their own capital, known as margin. unlike stocks, where you need to pay the full price upfront, futures trading lets you borrow capital from your broker, which could boost both potential profits and losses. What is leverage in futures trading? futures trading leverage allows traders to control a much larger contract value with a smaller margin deposit, giving them power to magnify both gains and losses. calculating leverage is straightforward: divide the notional value (the total value of the underlying asset in the contract) by the required margin.

How Leverage Works In Futures Trading Insignia Futures Options Leveraged trading consists of trading with borrowed capital from your broker in order to enhance your buying power. when a broker gives you a leverage factor (multiplier) of 1:10, 1:20 or any other, they’re referring to the amount of times that you’re buying power is amplified to. Leverage in futures trading is a mechanism that allows traders to control larger positions with a relatively small amount of capital. it's expressed as a ratio (e.g., 10:1) that indicates how much the trader's position size is multiplied compared to their actual capital investment. Trading with leverage lets traders manage big positions with less capital. futures trading is based on futures contracts. these are agreements to buy or sell something at a set price later. the market includes exchanges, brokers, and participants. Leverage trading amplifies trading power by allowing traders to control larger trade positions with a smaller initial investment. using leverage in futures trading can potentially maximize profits, especially in highly liquid markets with significant price movements.

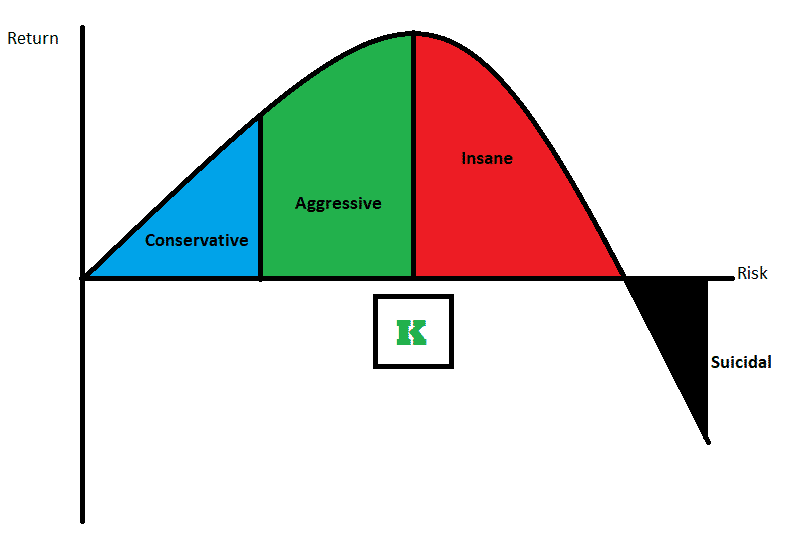

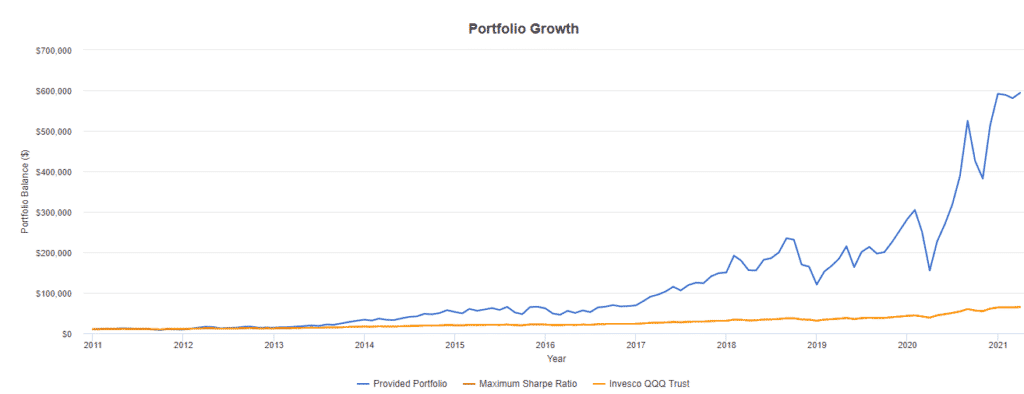

Using Leverage With Futures Risky Or Not Trading with leverage lets traders manage big positions with less capital. futures trading is based on futures contracts. these are agreements to buy or sell something at a set price later. the market includes exchanges, brokers, and participants. Leverage trading amplifies trading power by allowing traders to control larger trade positions with a smaller initial investment. using leverage in futures trading can potentially maximize profits, especially in highly liquid markets with significant price movements. Leverage is a key concept in futures trading, giving traders the ability to control larger positions with a smaller initial investment. it’s a powerful tool, but it also comes with its share of risks. One of the key features of futures trading is leverage, which allows traders to control a large position with a relatively small amount of capital. this blog explores the significance of leverage in futures trading, examining its mechanics, benefits, risks, and effective management strategies. what is leverage in futures trading?. Leverage futures trading is an advanced investment strategy that allows traders to control a larger position in the market than their initial capital would typically allow. by using leverage, traders can increase potential returns, but this also comes with higher risks. One of the key features of futures trading is leverage, which can significantly amplify both potential profits and losses. understanding how leverage works and the associated margin requirements is crucial for anyone looking to engage in futures trading. what is leverage?.

Using Leverage With Futures Risky Or Not Leverage is a key concept in futures trading, giving traders the ability to control larger positions with a smaller initial investment. it’s a powerful tool, but it also comes with its share of risks. One of the key features of futures trading is leverage, which allows traders to control a large position with a relatively small amount of capital. this blog explores the significance of leverage in futures trading, examining its mechanics, benefits, risks, and effective management strategies. what is leverage in futures trading?. Leverage futures trading is an advanced investment strategy that allows traders to control a larger position in the market than their initial capital would typically allow. by using leverage, traders can increase potential returns, but this also comes with higher risks. One of the key features of futures trading is leverage, which can significantly amplify both potential profits and losses. understanding how leverage works and the associated margin requirements is crucial for anyone looking to engage in futures trading. what is leverage?.

Using Leverage With Futures Risky Or Not Leverage futures trading is an advanced investment strategy that allows traders to control a larger position in the market than their initial capital would typically allow. by using leverage, traders can increase potential returns, but this also comes with higher risks. One of the key features of futures trading is leverage, which can significantly amplify both potential profits and losses. understanding how leverage works and the associated margin requirements is crucial for anyone looking to engage in futures trading. what is leverage?.

Using Leverage With Futures Risky Or Not