What Is Options Open Interest

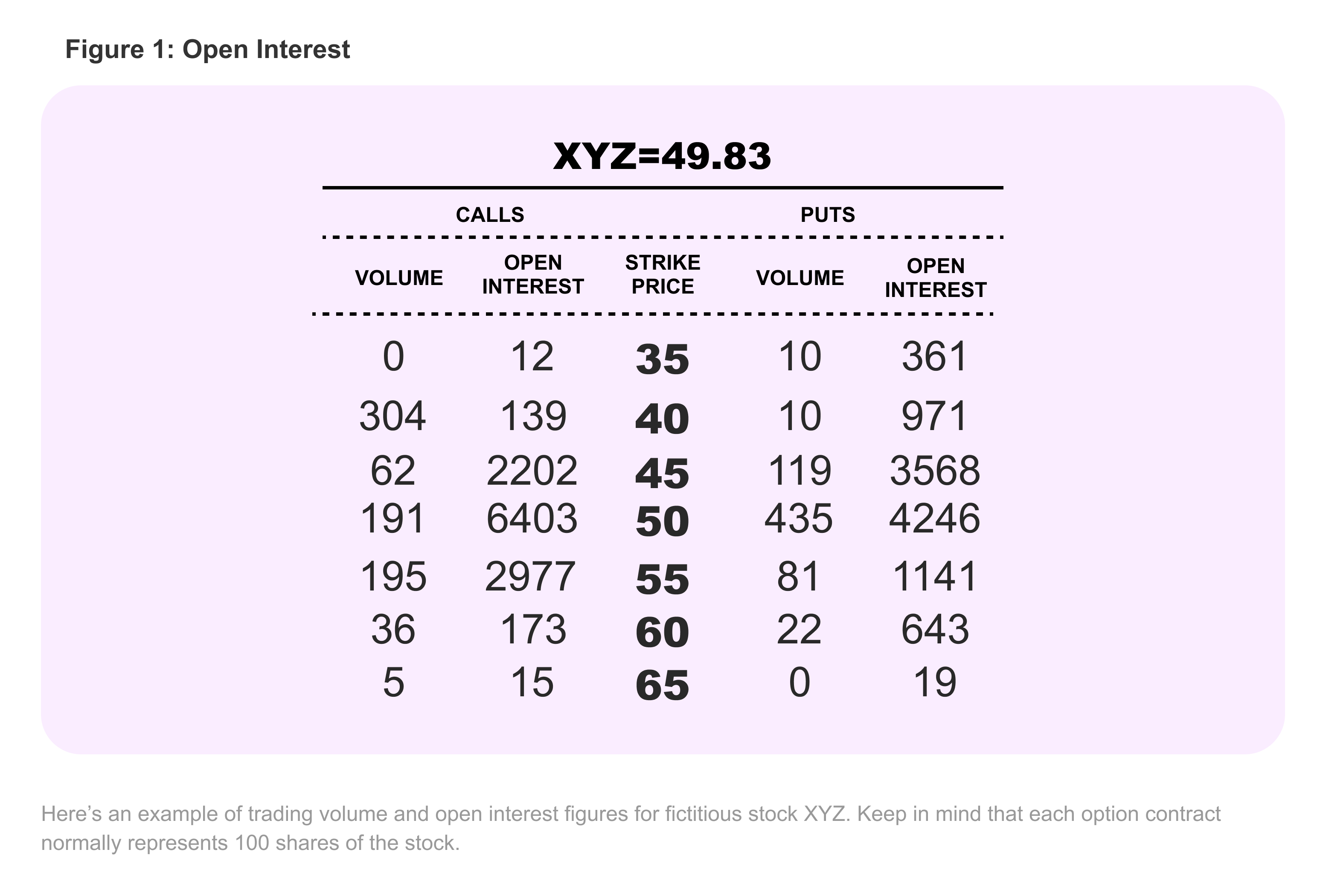

Open Interest Basics Pdf Option Finance Put Option Simply put, open interest is the number of option contracts that exist for a particular stock. they can be tallied on as large a scale as all open contracts on a stock, or can be measured more specifically as option type (call or put) at a specific strike price with a specific expiration. Demystify open interest in options trading. discover how this vital metric reflects market activity and helps predict future price movements.

Understanding Open Interest In Options Trading The Options Playbook But what is open interest in options trading? defined as the number of open call or put option contracts for a particular stock, open interest provides investors with a gauge of market sentiment. What does open interest mean in options? options open interest is the number of open contracts that remain for an expiration. this includes contracts that have not been exercised, offset, or expired. beginning options traders often confuse open interest with volume. Open interest is a concept that underpins the dynamics of the derivatives market, particularly futures and options contracts. it denotes the total number of outstanding derivative contracts that have not yet been settled or closed. In the options market, "open interest" refers to the total number of outstanding option contracts that are currently active and have not been settled or closed. as such, open interest provides insight into the liquidity and activity level of a particular option.

A Beginner S Guide To Options Open Interest Moneyreadme Open interest is a concept that underpins the dynamics of the derivatives market, particularly futures and options contracts. it denotes the total number of outstanding derivative contracts that have not yet been settled or closed. In the options market, "open interest" refers to the total number of outstanding option contracts that are currently active and have not been settled or closed. as such, open interest provides insight into the liquidity and activity level of a particular option. Before traders buy or sell options, they look at open interest. this metric refers to the number of outstanding options or futures contracts that are yet to be settled. it informs traders whether. Open interest (oi) is one of the most critical indicators for options and futures traders because it reveals the total number of outstanding contracts that remain active in the market. open interest helps traders understand the depth of participation and the strength behind market moves. In options, open interest refers to the number of outstanding contracts that have not been settled. here’s what else options traders should know about open interest including how it can inform.

A Beginner S Guide To Options Open Interest Moneyreadme Before traders buy or sell options, they look at open interest. this metric refers to the number of outstanding options or futures contracts that are yet to be settled. it informs traders whether. Open interest (oi) is one of the most critical indicators for options and futures traders because it reveals the total number of outstanding contracts that remain active in the market. open interest helps traders understand the depth of participation and the strength behind market moves. In options, open interest refers to the number of outstanding contracts that have not been settled. here’s what else options traders should know about open interest including how it can inform.

Comments are closed.