Monte Carlo Method In Option Pricing Xinran Katherine Zhang Monte carlo simulations have a vast array of applications in fields that are plagued by random variables, notably business and investing. they are used to estimate the probability of cost. The monte carlo simulation can be used in corporate finance, options pricing, and especially portfolio management and personal finance planning.

Monte Carlo Simulation Models Financetrainingcourse In mathematical finance, a monte carlo option model uses monte carlo methods [notes 1] to calculate the value of an option with multiple sources of uncertainty or with complicated features. [1] the first application to option pricing was by phelim boyle in 1977 (for european options). Discover how monte carlo simulations enhance option pricing by modeling uncertainty, generating price paths, and estimating fair values in financial analysis. monte carlo simulation is widely used in financial modeling to value options when analytical solutions like black scholes are impractical. Pricing options by monte carlo simulation is amongst the most popular ways to price certain types of financial options. this article will give a brief overview of the mathematics involved in simulating option prices using monte carlo methods, python code snippets and a few examples. monte carlo methods according to :. Monto carlo simulation is commonly used in equity options pricing. the prices of an underlying share are simulated for each possible price path, and the option payoffs are determined for each path. the payoffs are then averaged and discounted to today, which provides the current value of an option.

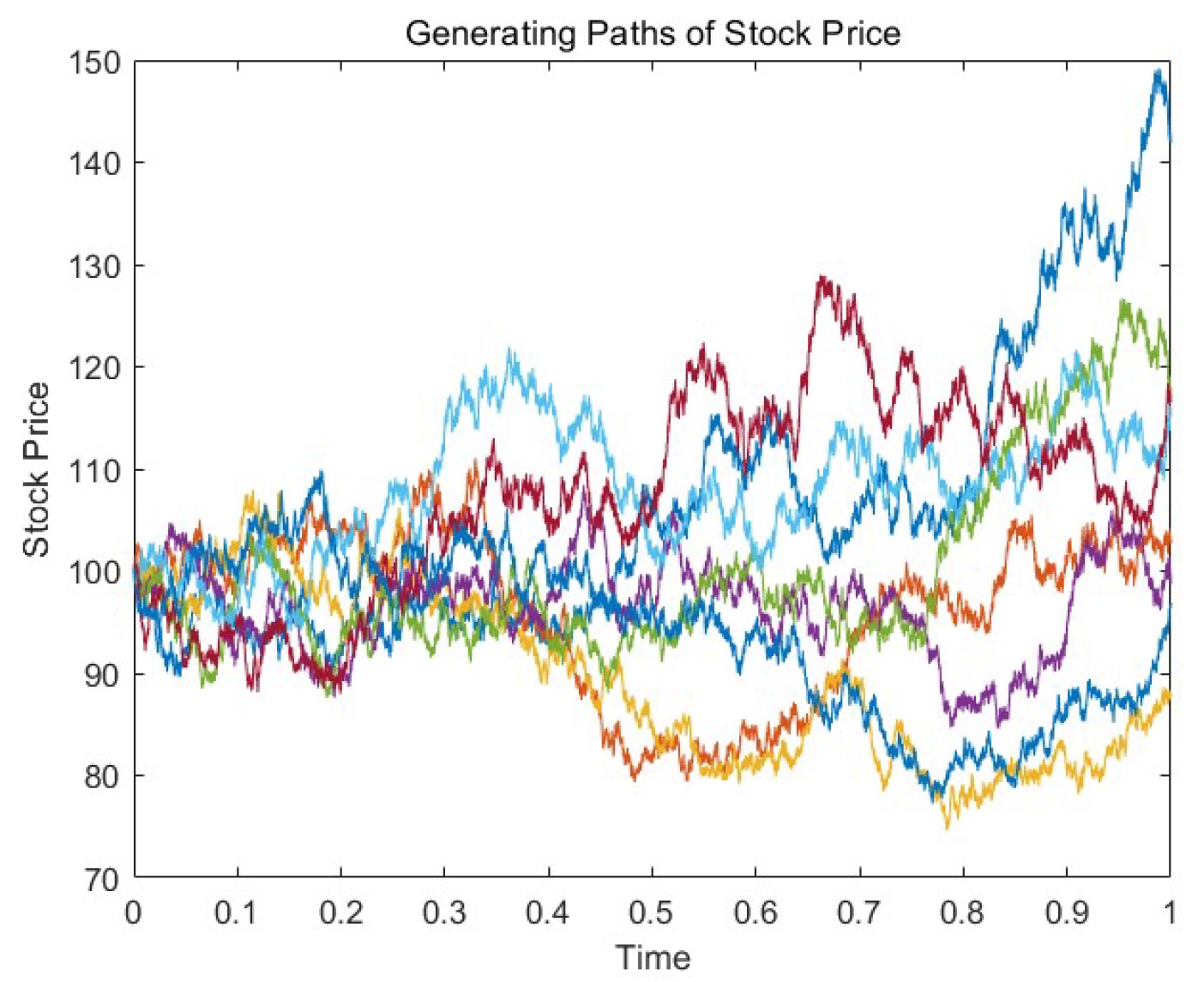

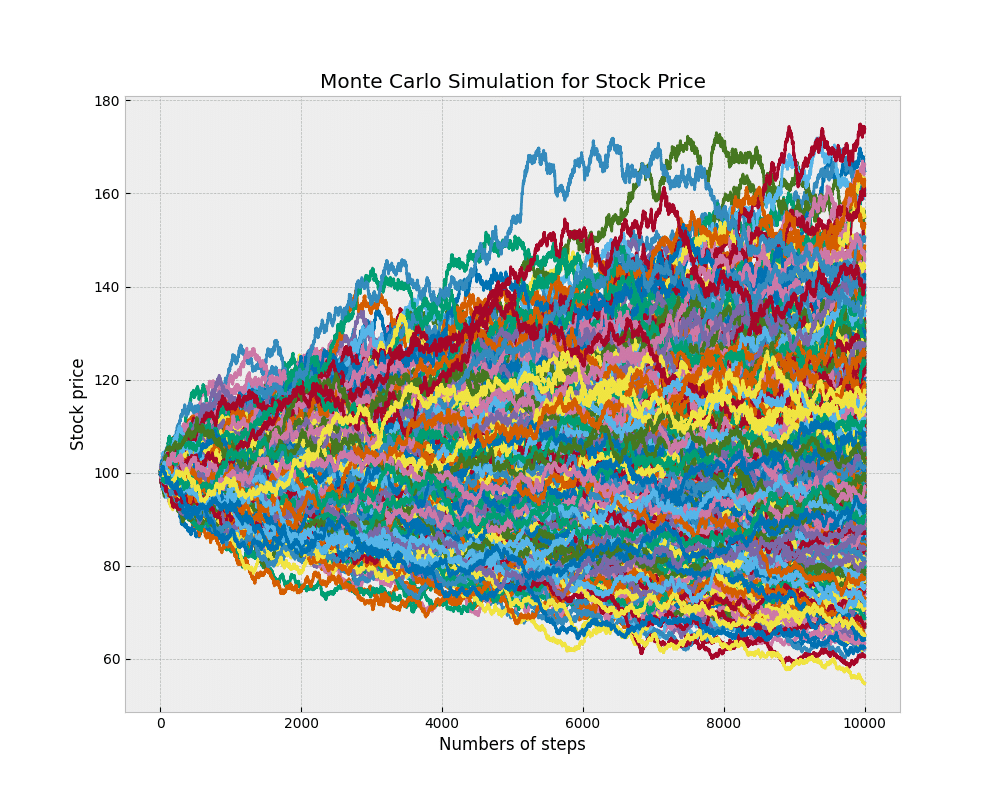

Options Pricing With Monte Carlo Simulation Tej Pricing options by monte carlo simulation is amongst the most popular ways to price certain types of financial options. this article will give a brief overview of the mathematics involved in simulating option prices using monte carlo methods, python code snippets and a few examples. monte carlo methods according to :. Monto carlo simulation is commonly used in equity options pricing. the prices of an underlying share are simulated for each possible price path, and the option payoffs are determined for each path. the payoffs are then averaged and discounted to today, which provides the current value of an option. In finance, monte carlo simulation is particularly valuable in assessing risk and uncertainty when analyzing the outcomes of investment portfolios, pricing options, evaluating business strategies, or making projections about future financial performance. In finance, monte carlo simulations are used extensively to price financial instruments like options, value portfolios, and assess risks. One of the most popular approaches to option pricing is monte carlo simulation (mcs). this method allows for the estimation of option prices by generating multiple random paths for the underlying asset and computing the expected payoff at maturity. By simulating these scenarios, monte carlo methods for option pricing can estimate the expected value of an option, taking into account various factors such as volatility, interest rates, and time to expiration.

Monte Carlo Simulation In Finance Traditional And Decentralized In finance, monte carlo simulation is particularly valuable in assessing risk and uncertainty when analyzing the outcomes of investment portfolios, pricing options, evaluating business strategies, or making projections about future financial performance. In finance, monte carlo simulations are used extensively to price financial instruments like options, value portfolios, and assess risks. One of the most popular approaches to option pricing is monte carlo simulation (mcs). this method allows for the estimation of option prices by generating multiple random paths for the underlying asset and computing the expected payoff at maturity. By simulating these scenarios, monte carlo methods for option pricing can estimate the expected value of an option, taking into account various factors such as volatility, interest rates, and time to expiration.

Monte Carlo Simulation And Finance Gfxtra One of the most popular approaches to option pricing is monte carlo simulation (mcs). this method allows for the estimation of option prices by generating multiple random paths for the underlying asset and computing the expected payoff at maturity. By simulating these scenarios, monte carlo methods for option pricing can estimate the expected value of an option, taking into account various factors such as volatility, interest rates, and time to expiration.

Comprehensive Monte Carlo Simulation Tutorial Toptal