What S The Best Asset Allocation For Retirees Iese Insight

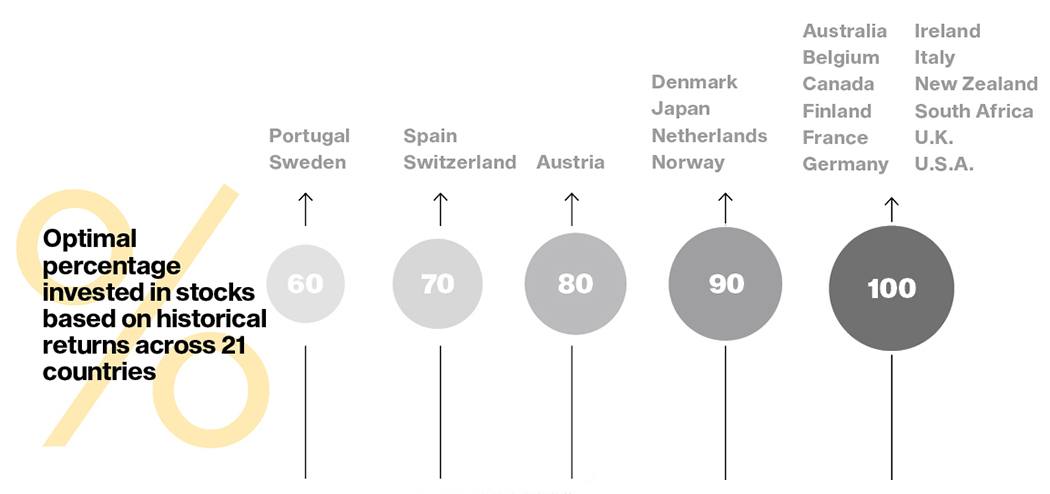

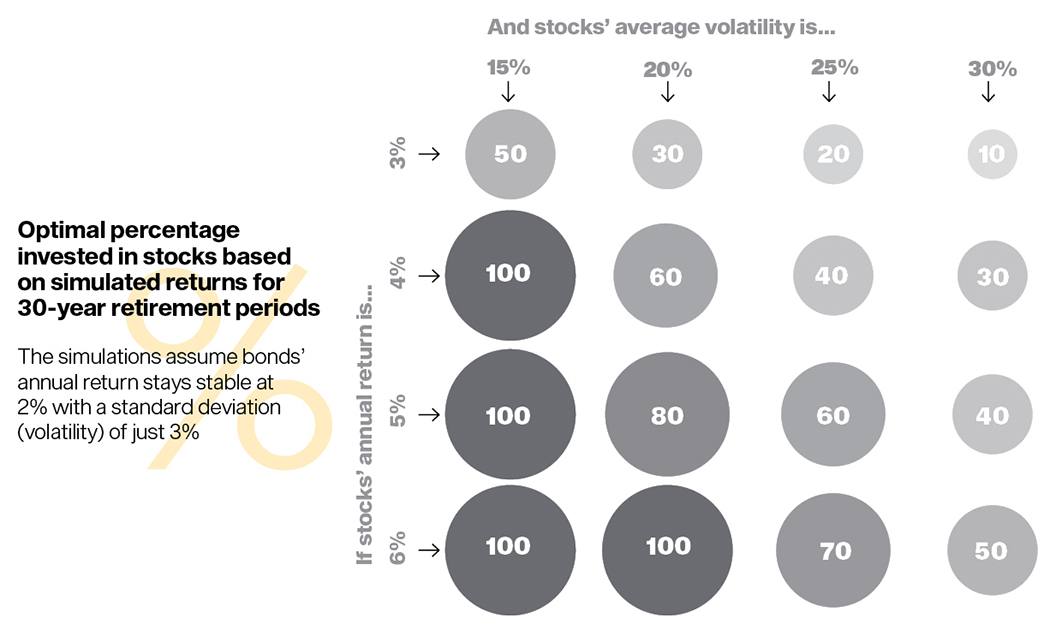

What S The Best Asset Allocation For Retirees Iese Insight Using this framework, the researchers look at both historical and simulated scenarios to suggest optimal asset allocation strategies for stocks and bonds. historical: the study's dataset includes over a century's worth of annual returns for both stocks and bonds from 1900 to 2014 for 21 countries and the world market. To address the shortcomings of the failure rate and provide more information about different retirement investment strategies, iese’s javier estrada and mark kritzman of windham capital.

What S The Best Asset Allocation For Retirees Iese Insight To address the shortcomings of the failure rate and provide more information about different retirement investment strategies, iese's javier estrada and mark kritzman of windham capital management have developed a new metric they call the coverage ratio. Therefore, based on the research conducted for this paper, as well as other qualitative and practical considerations, the optimal allocation for most retirees is likely a balanced portfolio, such as a 60 percent equity and 40 percent fixed income cash allocation. Today, with longer life expectancies and market volatility, a personalized asset allocation strategy is paramount. consider the “bucket strategy,” segmenting your assets into short term, medium term, and long term needs, ensuring liquidity and growth. Let growth be your goa l, consistency be your edge, and fear take a backseat. asset allocation: 90 100% stocks 0 10% stable assets. savings target: 1x annual salary by age 30. why this works: you have 35 45 years until retirement. market crashes are just sales on future wealth. real world example: investment strategy:.

What S The Best Asset Allocation For Retirees Iese Insight Today, with longer life expectancies and market volatility, a personalized asset allocation strategy is paramount. consider the “bucket strategy,” segmenting your assets into short term, medium term, and long term needs, ensuring liquidity and growth. Let growth be your goa l, consistency be your edge, and fear take a backseat. asset allocation: 90 100% stocks 0 10% stable assets. savings target: 1x annual salary by age 30. why this works: you have 35 45 years until retirement. market crashes are just sales on future wealth. real world example: investment strategy:. In an article published in retirement management journal, which received a 2025 journal research award, iese prof. javier estrada provides a step by step guide for creating a retirement plan. it involves investing money to build a target portfolio over a long period of time. The right mix of stocks, bonds, and other assets can determine whether i outlive my money or enjoy financial security. in this guide, i explore the best asset allocation strategies for retirees like me, backed by research, mathematical models, and real world examples. Changing the most important of those assumptions, to learn how deeply a recommendation depends upon its key inputs, creates insight. investors won't ever calculate multidimensionally, as the. Learn the asset allocation strategies for retirees to balance growth and income, manage risk in a retirement portfolio.

Retire At Your Own Risk Iese Insight In an article published in retirement management journal, which received a 2025 journal research award, iese prof. javier estrada provides a step by step guide for creating a retirement plan. it involves investing money to build a target portfolio over a long period of time. The right mix of stocks, bonds, and other assets can determine whether i outlive my money or enjoy financial security. in this guide, i explore the best asset allocation strategies for retirees like me, backed by research, mathematical models, and real world examples. Changing the most important of those assumptions, to learn how deeply a recommendation depends upon its key inputs, creates insight. investors won't ever calculate multidimensionally, as the. Learn the asset allocation strategies for retirees to balance growth and income, manage risk in a retirement portfolio.

Comments are closed.