What You Need To Know About The Itc Solar Tax Credit Decreasing After What is the solar tax credit? the itc is a dollar for dollar reduction of the income tax you owe upon purchasing a solar power system. it’s different from a discount as people have to be paying taxes to be eligible. however, since most people do pay tax, their eligibility is implied. While the future of the itc under the trump administration remains uncertain, we’ll break down what we do know about the executive order and its potential impact on solar energy in the u.s. can trump legally defund the itc?.

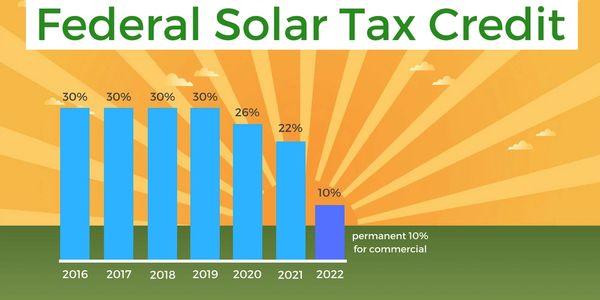

Itc Solar Tax Credit Native First, the new law eliminates the solar itc step down for the next decade, setting the tax credit at 30% through 2032. the chart below shows how this move significantly decreases investment costs for commercial solar installations, especially those that don’t commence construction this year. For solar energy systems, the credit is set to drop from 26% to 22% in 2023 and will be eliminated for residential properties and reduced to 10% for commercial properties starting in 2024, unless congress renews it. this phasedown underscores the importance of acting sooner rather than later to maximize the benefits. The federal solar tax credit, officially known as the investment tax credit (itc), has been extended and enhanced by the inflation reduction act of 2022, offering a 30% tax credit for solar installations from 2022 to 2032, before decreasing to 26% in 2033 and 22% in 2034, with the aim of making solar energy systems more affordable and. The bill would phase out the two tax credits by 20% per year for five years starting in the taxable years beginning after passage of the act. the bill also proposes to eliminate transferability of solar and wind tax credits. tax credits are estimated to have already catalyzed more than $500 billion in private capital since 2022.

Solar Tax Credit Itc The federal solar tax credit, officially known as the investment tax credit (itc), has been extended and enhanced by the inflation reduction act of 2022, offering a 30% tax credit for solar installations from 2022 to 2032, before decreasing to 26% in 2033 and 22% in 2034, with the aim of making solar energy systems more affordable and. The bill would phase out the two tax credits by 20% per year for five years starting in the taxable years beginning after passage of the act. the bill also proposes to eliminate transferability of solar and wind tax credits. tax credits are estimated to have already catalyzed more than $500 billion in private capital since 2022. Let’s take a look at the biggest changes and what they mean for americans who install rooftop solar: the itc increased in amount and its timeline has been extended. those who install a pv system between 2022 and 2032 will receive a 30% tax credit. that will decrease to 26% for systems installed in 2033 and to 22% for systems installed in 2034. An overview of the itc tax credit and the changes to expect: there are two federal tax credits available to incentivize the adoption of solar and solar investments: section 48 solar investment tax credit (itc) and the section 25d residential solar energy credit available to businesses and homeowners respectively. The ira introduced historic clean energy subsidies, including investment tax credits (itc) and production tax credits (ptc), to promote renewable energy production and reduce greenhouse gas (ghg) emissions. after extensive deliberation, the biden administration has finalized critical rules for many of the legislation’s clean energy tax. What are the current solar tax credits? the federal solar tax credit, known as the investment tax credit (itc), allows you to deduct 30% of the cost of installing a solar energy system from your federal taxes. this initiative has significantly bolstered solar adoption across the u.s. by making solar installations more affordable. the 2025.

Solar Investment Tax Credit Itc Sunwork Let’s take a look at the biggest changes and what they mean for americans who install rooftop solar: the itc increased in amount and its timeline has been extended. those who install a pv system between 2022 and 2032 will receive a 30% tax credit. that will decrease to 26% for systems installed in 2033 and to 22% for systems installed in 2034. An overview of the itc tax credit and the changes to expect: there are two federal tax credits available to incentivize the adoption of solar and solar investments: section 48 solar investment tax credit (itc) and the section 25d residential solar energy credit available to businesses and homeowners respectively. The ira introduced historic clean energy subsidies, including investment tax credits (itc) and production tax credits (ptc), to promote renewable energy production and reduce greenhouse gas (ghg) emissions. after extensive deliberation, the biden administration has finalized critical rules for many of the legislation’s clean energy tax. What are the current solar tax credits? the federal solar tax credit, known as the investment tax credit (itc), allows you to deduct 30% of the cost of installing a solar energy system from your federal taxes. this initiative has significantly bolstered solar adoption across the u.s. by making solar installations more affordable. the 2025.