World Oil Supply And Price Outlook August 2019 Ino Trader S Blog Cbot chicago board of trade; cme chicago mercantile exchange; clrp clearport; ice intercontinental exchange; kcbt kansas city board of trade; mgex minneapolis grain exchange; nymex new york mercantile exchange; all futures & commodity symbols. The iea oil market report (omr) is one of the world’s most authoritative and timely sources of data, forecasts and analysis on the global oil market – including detailed statistics and commentary on oil supply, demand, inventories, prices and refining activity, as well as oil trade for iea and selected non iea countries.

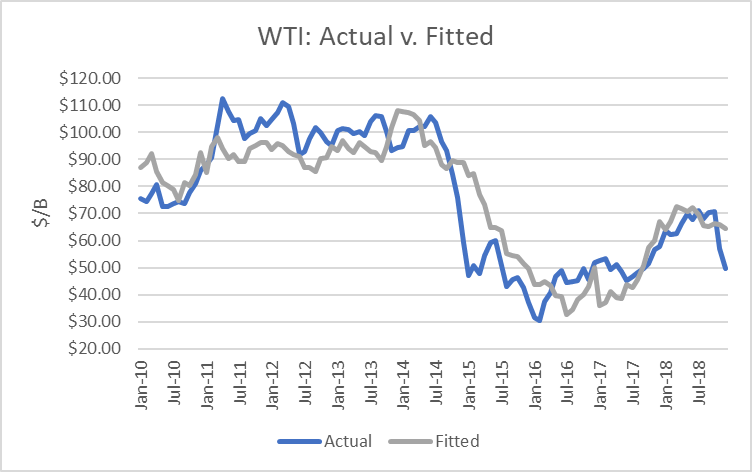

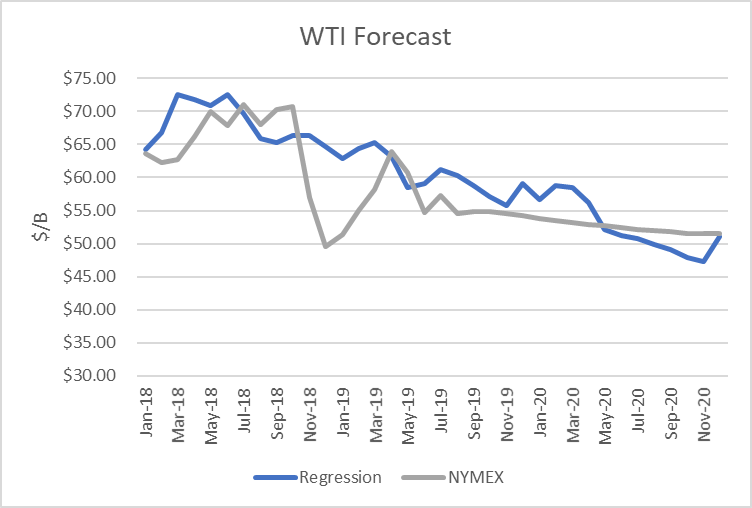

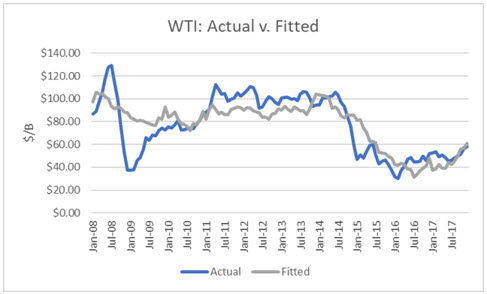

World Oil Supply And Price Outlook August 2019 Ino Trader S Blog The 4q18 proved that oil prices can move dramatically based on expectations and that they can drop far below the model’s valuations. the attack on aramco’s oil facilities also proves they can rise above the model derived price. the saudi incident raised fears that oil supplies might be significantly reduced. World oil supply and price outlook august 2019 > tinyurl yy55te8r $uso $ung $sco $uco $cvx #crudeoil #naturalgas #stockstotrade. Opec’s world oil outlook (woo) is part of the organization’s commitment to market stability. the publication is a means to highlight and further the understanding of the many possible future challenges and opportunities that lie ahead for the oil industry. I used the model to assess wti oil prices for the eia forecast period through 2020 and 2021 and compared the regression equation forecast to actual nymex futures prices as of august 10th. the result is that oil futures prices are presently overvalued through august 2020. however, futures prices are undervalued starting in october 2020 through.

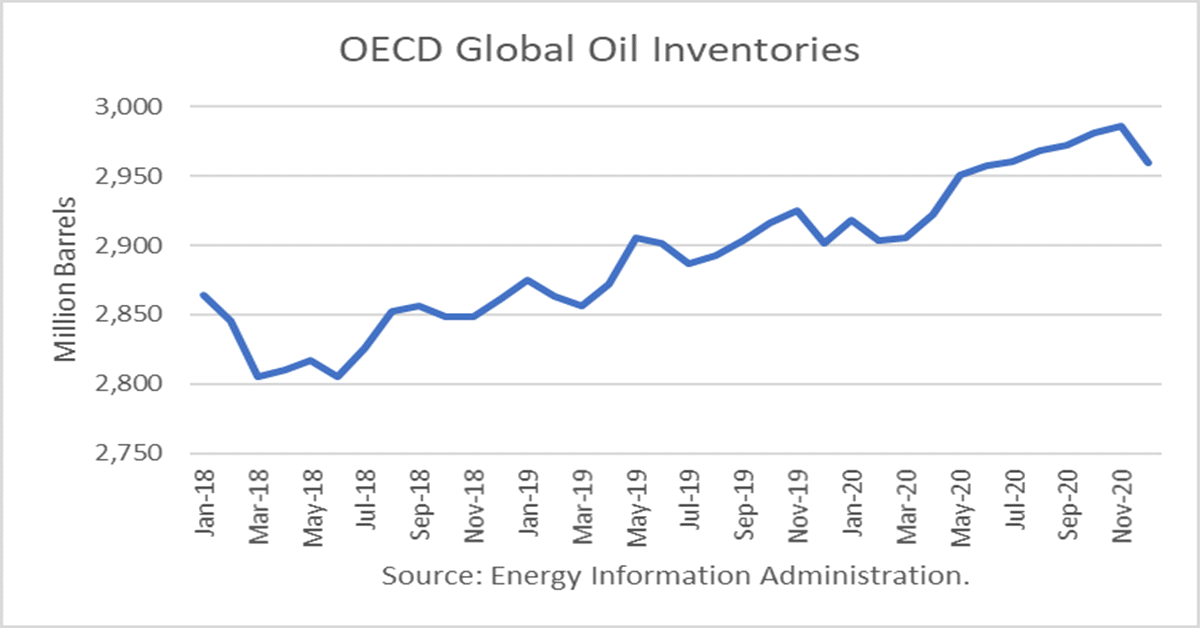

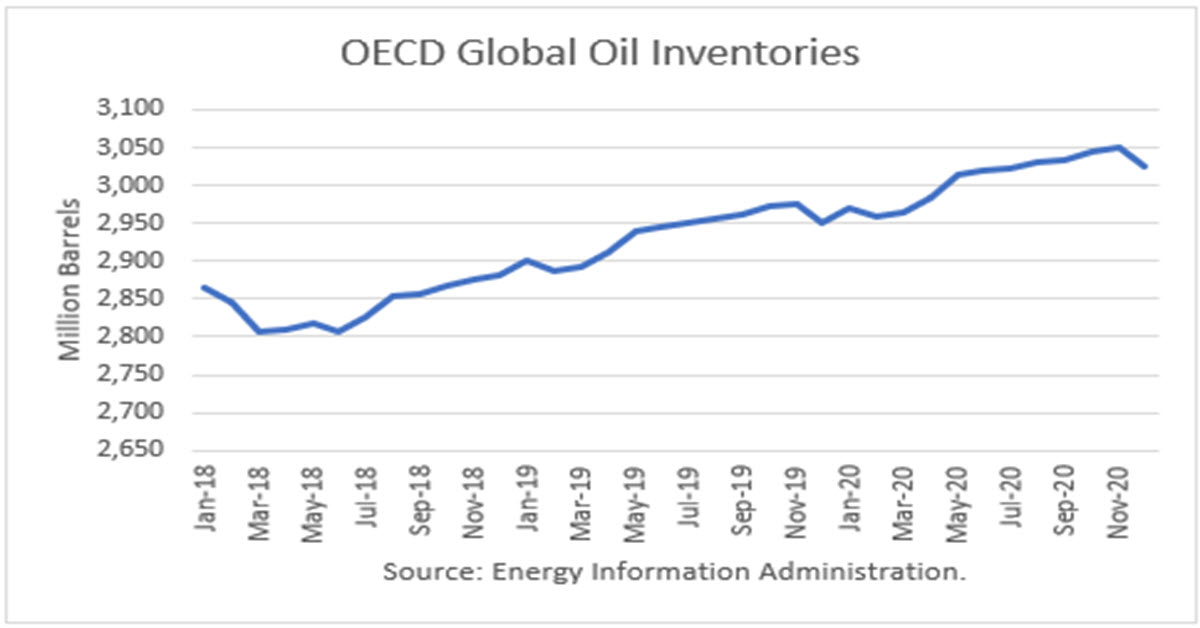

World Oil Supply And Price Outlook August 2019 Ino Trader S Blog Opec’s world oil outlook (woo) is part of the organization’s commitment to market stability. the publication is a means to highlight and further the understanding of the many possible future challenges and opportunities that lie ahead for the oil industry. I used the model to assess wti oil prices for the eia forecast period through 2020 and 2021 and compared the regression equation forecast to actual nymex futures prices as of august 10th. the result is that oil futures prices are presently overvalued through august 2020. however, futures prices are undervalued starting in october 2020 through. Eia continues to lower oil price demand growth forecasts . crude oil storage and capacity have increased in cushing . crude oil storage at cushing but not storage capacity . The energy information administration released its short term energy outlook for september, and it shows that oecd oil inventories likely bottomed in july at 2.804 billion barrels. it shows inventories rising in the third quarter, contrary to the usual seasonal trend. This year, the report covers the following themes: a changed supply picture led by the rise of the united states in world markets thanks to rapidly growing shale oil production, as it becomes a net exporter of crude oil and products; supply growth in the non opec world, including brazil, canada, norway and guyana; and a falling capacity for the.

World Oil Supply Demand And Price Outlook January 2019 Ino Eia continues to lower oil price demand growth forecasts . crude oil storage and capacity have increased in cushing . crude oil storage at cushing but not storage capacity . The energy information administration released its short term energy outlook for september, and it shows that oecd oil inventories likely bottomed in july at 2.804 billion barrels. it shows inventories rising in the third quarter, contrary to the usual seasonal trend. This year, the report covers the following themes: a changed supply picture led by the rise of the united states in world markets thanks to rapidly growing shale oil production, as it becomes a net exporter of crude oil and products; supply growth in the non opec world, including brazil, canada, norway and guyana; and a falling capacity for the.

World Oil Supply Demand And Price Outlook January 2019 Ino This year, the report covers the following themes: a changed supply picture led by the rise of the united states in world markets thanks to rapidly growing shale oil production, as it becomes a net exporter of crude oil and products; supply growth in the non opec world, including brazil, canada, norway and guyana; and a falling capacity for the.