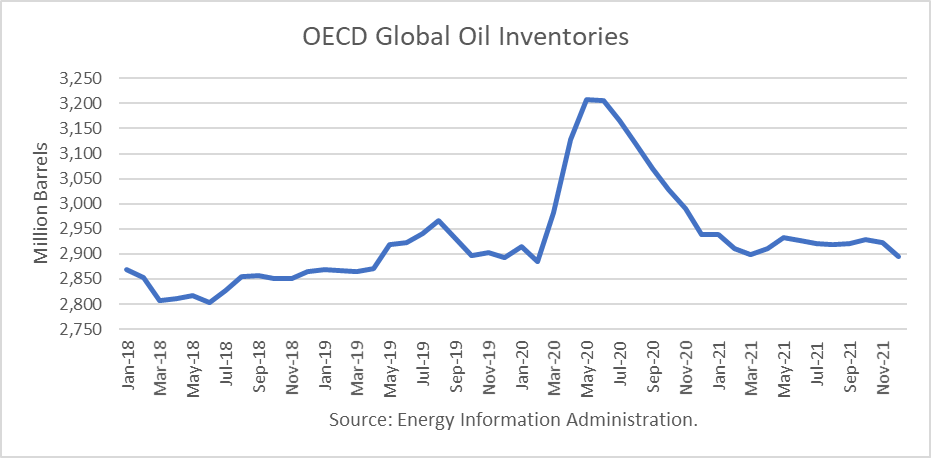

World Oil Supply And Price Outlook September 2020 Ino Trader S Blog The energy information administration released its short term energy outlook for september, and it shows that oecd oil inventories likely bottomed in this cycle in june 2018 at 2.804 billion barrels. it estimated stocks dropped by 45 million barrels in august to end at 3.120 billion, 179 million barrels higher than a year ago. In september 2020, it estimated stocks dropped by 34 million barrels to end at 3.090 billion, 123 million barrels higher than a year ago. the eia estimated global oil production at 91.70 million barrels per day (mmbd) for september, compared to global oil consumption of 95.26 mmbd.

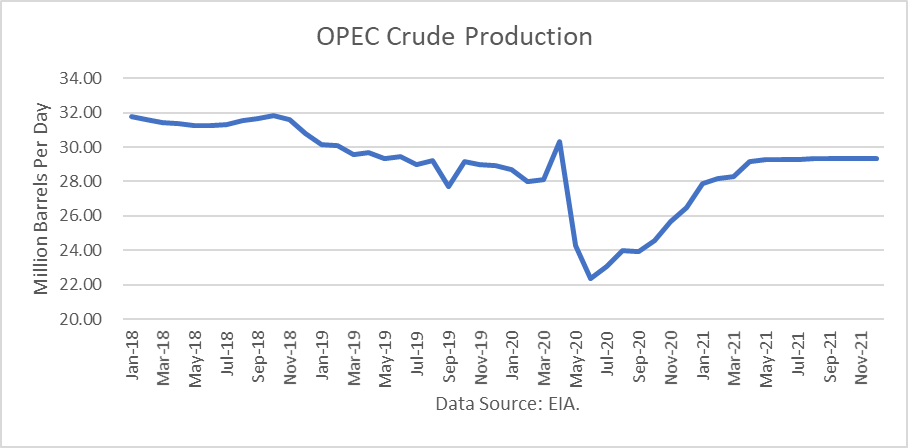

World Oil Supply And Price Outlook September 2020 Ino Trader S Blog Covid 19 sent shocks through global oil markets, with oil demand and supply still struggling to return to pre pandemic levels. our outlook looks back at 2020 and presents our most likely scenarios for oil demand, supply, and prices through 2040. Oil consumption in our forecast continues to be below its pre pandemic trend. recently announced trade policies mean the uncertainty around global oil demand growth has risen significantly. we expect world consumption of petroleum and other liquid fuels to be 0.9 million b d more in 2025 than it was last year, with growth of 1.0 million b d in. Oil prices. post navigation. world oil supply and price outlook, july 2020. leave a reply cancel reply. save my name, email, and website in this browser for the next time i comment. Δ. search trader’s blog. search for: 20403. build a long term portfolio in minutes. try magnifi personal free trial. recent posts. is intel a buy? deep. With the cost of living crisis affecting consumer behavior in major markets such as china and germany, economic stagnation has already resulted in oil production outperforming demand to a degree.

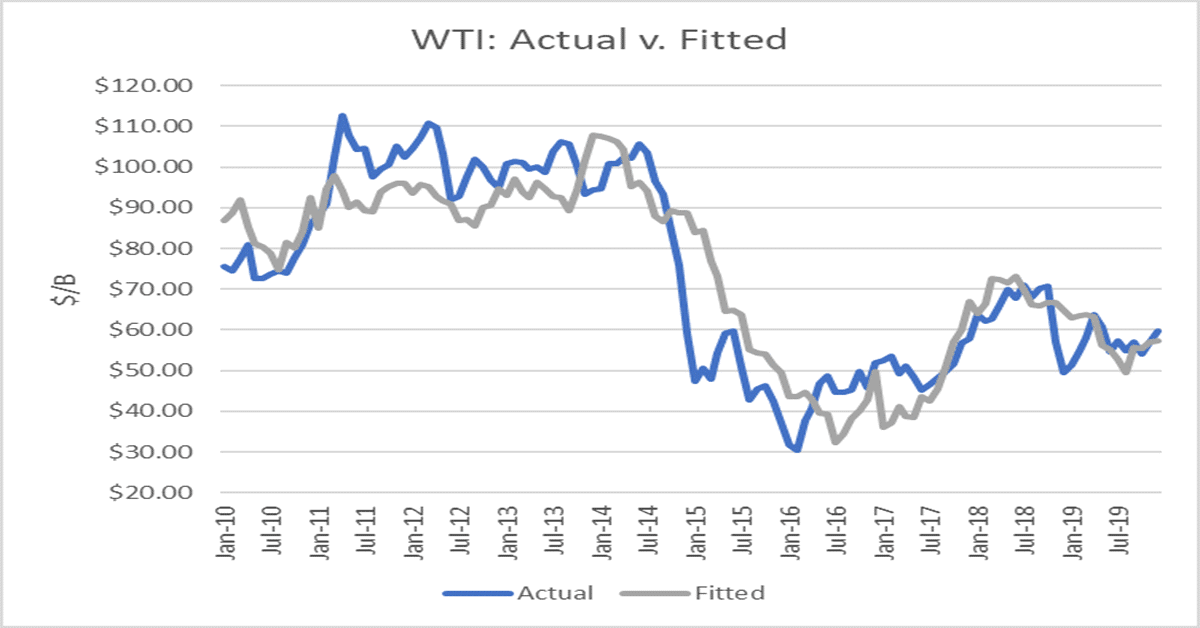

World Oil Supply And Price Outlook September 2020 Ino Trader S Blog Oil prices. post navigation. world oil supply and price outlook, july 2020. leave a reply cancel reply. save my name, email, and website in this browser for the next time i comment. Δ. search trader’s blog. search for: 20403. build a long term portfolio in minutes. try magnifi personal free trial. recent posts. is intel a buy? deep. With the cost of living crisis affecting consumer behavior in major markets such as china and germany, economic stagnation has already resulted in oil production outperforming demand to a degree. Opec’s world oil outlook (woo) is part of the organization’s commitment to market stability. the publication is a means to highlight and further the understanding of the many possible future challenges and opportunities that lie ahead for the oil industry. Assessing prospects for future oil prices is an uncertain activity but, barring middle east conflict creating severe supply issues, crude oil prices are expected to stage a recovery by third quarter 2020 and modest further recovery in first half 2021, with the range $40 to $60 per barrel for wti and brent. The two major uncertainties are how deep the demand destruction will be worldwide, how long it will last, and how much the oil price war will inflate production and how long it will last. a minor uncertainty, by comparison, is how much low oil prices will dampen non opec oil production and when that will kick in. Crude oil prices & gas price charts. oil price charts for brent crude, wti & oil futures. energy news covering oil, petroleum, natural gas and investment advice.

World Oil Supply And Price Outlook April 2020 Ino Trader S Blog Opec’s world oil outlook (woo) is part of the organization’s commitment to market stability. the publication is a means to highlight and further the understanding of the many possible future challenges and opportunities that lie ahead for the oil industry. Assessing prospects for future oil prices is an uncertain activity but, barring middle east conflict creating severe supply issues, crude oil prices are expected to stage a recovery by third quarter 2020 and modest further recovery in first half 2021, with the range $40 to $60 per barrel for wti and brent. The two major uncertainties are how deep the demand destruction will be worldwide, how long it will last, and how much the oil price war will inflate production and how long it will last. a minor uncertainty, by comparison, is how much low oil prices will dampen non opec oil production and when that will kick in. Crude oil prices & gas price charts. oil price charts for brent crude, wti & oil futures. energy news covering oil, petroleum, natural gas and investment advice.