Zero Based Budgeting Definition Process Advantages Or 41 Off Several advantages and disadvantages of zero based budgeting are worth taking into consideration. 1. it keeps you aware of your cash flows. when you are using a zero based budget, then you are entirely aware of how much money is going into and out of your accounts each month. The following can be disadvantages of zero based budgeting: it is time consuming as every time it had to start from scratch. it can be costly as more skills and expertise is required. conclusion: zero based budgeting aims at reflecting true expenses to be incurred by a department or a state (in the case of budget making by the government.

Advantages And Disadvantages Of Zero Based Budgeting Efm The major advantages of zero based budgeting are flexible budgets, focused operations, lower costs, and more disciplined execution. managers must justify all operating expenses. The advantages and disadvantages of zero based budgeting weigh tighter expense controls and better goal alignment with a greater lift in time and resources. as more finance chiefs shift to this approach in the face of inflation and other economic factors, it’s a good time to consider whether or not the zero based approach is right for your. In this blog post, we will delve into the concept of zero based budgeting, exploring its definition, advantages, disadvantages, implementation steps and tools needed. what is zero based budgeting? the zero based budgeting process is a strategic budgeting approach that mandates a fresh evaluation of all expenses during each budgeting cycle. Zero based budgeting targets identifying efficient and alternative methods for organizations that opt for optimum utilization of resources. this will not only ensure efficiency and effectiveness but also wealth and profitability. any process will have advantages and disadvantages.

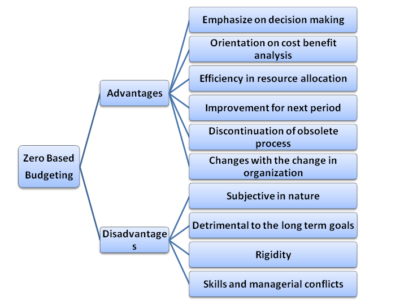

Zero Based Budgeting Meaning Features Process In this blog post, we will delve into the concept of zero based budgeting, exploring its definition, advantages, disadvantages, implementation steps and tools needed. what is zero based budgeting? the zero based budgeting process is a strategic budgeting approach that mandates a fresh evaluation of all expenses during each budgeting cycle. Zero based budgeting targets identifying efficient and alternative methods for organizations that opt for optimum utilization of resources. this will not only ensure efficiency and effectiveness but also wealth and profitability. any process will have advantages and disadvantages. Advantages and disadvantages of zero based budgeting are listed in figure 1. figure 1: advantages and disadvantages of zbb. zero based budgeting (zbb) key takeaways. zero based budgeting (zbb) is an essential tool for organizations, particularly large ones and those in the public sector, as it promotes a more strategic and needs based. Zero based budgeting advantages and disadvantages. here’s a summary of the pros and cons of zero based budgeting: advantages: optimizes resource allocation. enhances accountability and transparency. promotes cost control and eliminates redundancy. adapts to changing organizational priorities. disadvantages: time intensive and complex. Disadvantages of zbb: the technique of zero base budgeting suffers from the following limitations: 1. the costs involved in preparing a huge number of decision packages in a large firm are very high. 2. identification as well as development of decision packages is very tiresome work and large amount of additional paperwork is involved. Unlike traditional budgeting methods, zero based budgeting requires all expenses to be justified for each new budgeting period, without considering previous allocations. this approach offers both advantages and disadvantages to organizations and individuals seeking to maximize their financial resources.