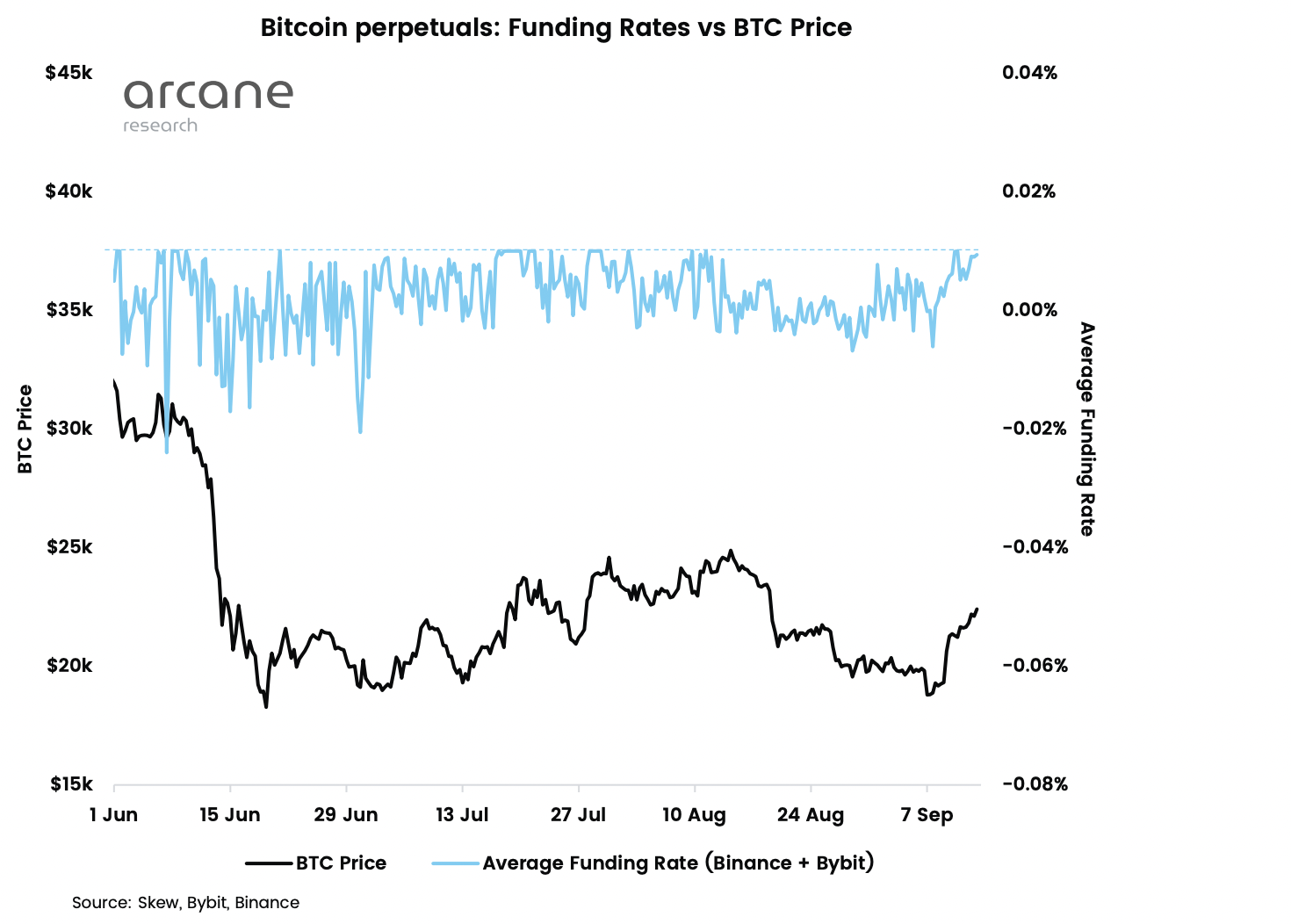

Bitcoin Open Interest Funding Rates Point To Growing Bullish Sentiment

Bitcoin Open Interest Funding Rates Point To Growing Bullish Sentiment Bitcoin is a peer to peer electronic payment system. it is the leading online currency and can be used to pay for goods and services, just like paper money. Bitcoin is a peer to peer electronic payment system. it is the leading online currency and can be used to pay for goods and services, just like paper money.

Bitcoin Funding Rates Looking Bullish Here S What It Means Bitcoin is a peer to peer electronic payment system. it is the leading online currency and can be used to pay for goods and services, just like paper money. Bitcoin usa tecnología peer to peer o entre pares para operar sin una autoridad central o bancos; la gestión de las transacciones y la emisión de bitcoins es llevada a cabo de forma colectiva por la red. bitcoin es de código abierto; su diseño es público, nadie es dueño o controla bitcoin y todo el mundo puede participar. por medio de sus muchas propiedades únicas, bitcoin permite usos. Debe tener paciencia la sincronizazción inicial de bitcoin core puede tomar un largo tiempo. debería asegurarse de que dispone de suficiente ancho de banda y espacio de almacenamiento para la descarga completa de lacadena de bloques (más de 20gb). si sabe como descargar un archivo torrent, puede acelerar el proceso poniendo bootstrap.dat ( una copia anterior de la cadena de bloques) en el. Você precisará ter paciência a sincronização inicial com bitcoin core pode levar bastante tempo. você deve assegurar se de ter largura de banda e memória suficiente para o tamanho inteiro do block chain (mais de 20gb). se você souber como fazer o download de um arquivo torrente, você pode acelerar esse processo colocando bootstrap.dat (uma cópia prévia do block chain) no diretório.

Bitcoin Btc Futures Trading Intensifies With Growing Bullish Sentiment Debe tener paciencia la sincronizazción inicial de bitcoin core puede tomar un largo tiempo. debería asegurarse de que dispone de suficiente ancho de banda y espacio de almacenamiento para la descarga completa de lacadena de bloques (más de 20gb). si sabe como descargar un archivo torrent, puede acelerar el proceso poniendo bootstrap.dat ( una copia anterior de la cadena de bloques) en el. Você precisará ter paciência a sincronização inicial com bitcoin core pode levar bastante tempo. você deve assegurar se de ter largura de banda e memória suficiente para o tamanho inteiro do block chain (mais de 20gb). se você souber como fazer o download de um arquivo torrente, você pode acelerar esse processo colocando bootstrap.dat (uma cópia prévia do block chain) no diretório. Bitcoin is a peer to peer electronic payment system. it is the leading online currency and can be used to pay for goods and services, just like paper money. Bitcoin forum is a community of developers, academics, and entrepreneurs dedicated to promoting and improving bitcoin. Bitcoin é diferente daquilo que você conhece e usa diariamente. antes de você começar usar bitcoin para qualquer transação séria, assegure se de ler o que você precisa saber e dê os passos apropriados para proteger sua carteira. Загрузить bitcoin core Последняя версия: 0.10.2 windows 64 bit 32 bit windows (zip) 64 bit 32 bit mac os x dmg tar.gz.

Bitcoin Open Interest Hits Record 19 8b Signaling Bullish Sentiment Bitcoin is a peer to peer electronic payment system. it is the leading online currency and can be used to pay for goods and services, just like paper money. Bitcoin forum is a community of developers, academics, and entrepreneurs dedicated to promoting and improving bitcoin. Bitcoin é diferente daquilo que você conhece e usa diariamente. antes de você começar usar bitcoin para qualquer transação séria, assegure se de ler o que você precisa saber e dê os passos apropriados para proteger sua carteira. Загрузить bitcoin core Последняя версия: 0.10.2 windows 64 bit 32 bit windows (zip) 64 bit 32 bit mac os x dmg tar.gz.

Comments are closed.